Chinese fast fashion retailer Shein may be forced to ditch its planned London IPO because of the chaos caused by President Trump’s tariffs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Production Alternatives

A report in the Financial Times stated that the company was putting its efforts and energy into working out ways to lessen the impact of the U.S. trade war which has imposed a huge 145% tariff rate on Chinese imports.

Shein’s U.S. business which reportedly accounts for about one-third of its $38 billion in annual revenue will be additionally battered when the “de minimis” tax exemption for smaller goods ends this week.

It is understood that one way Shein is looking to avoid the hit is by diverting production for the U.S. market to countries outside China. It currently has some manufacturing in Brazil and Turkey but the FT said that it would struggle to meet the scale of Shein’s operations in China.

This would cut the amount of products it can send to the U.S. and also likely upset Beijing which has been putting pressure on domestic exporters not to move their supply chains out of the mainland.

London Loses its Shine

If tariffs do hit the business badly then it is expected that its plans to list in London in the first half of this year may be shelved.

“Internally we are all focused on figuring out how to deal with the tariff situation at the moment. Before we have clarity on that, no one can even start to think about the IPO,” said one executive as reported by the FT.

“Figuring out how to survive Trump 2.0 is something occupying boards around the globe and until the dust settles it’s highly unlikely Shein will feel able to take the necessary steps towards a public listing in the U.K.,” said AJ Bell’s head of financial analysis Danni Hewson.

It was reported earlier this month that Shein had secured the green light from the U.K. financial regulator to list its shares in London.

Shein, which had been considering a listing in the U.S. until concerns over its labor practices, sells $10 dresses and $12 jeans in more than 150 countries and was valued at $66 billion in its last fundraising round in 2023.

What are the Best Chinese Stocks to Buy?

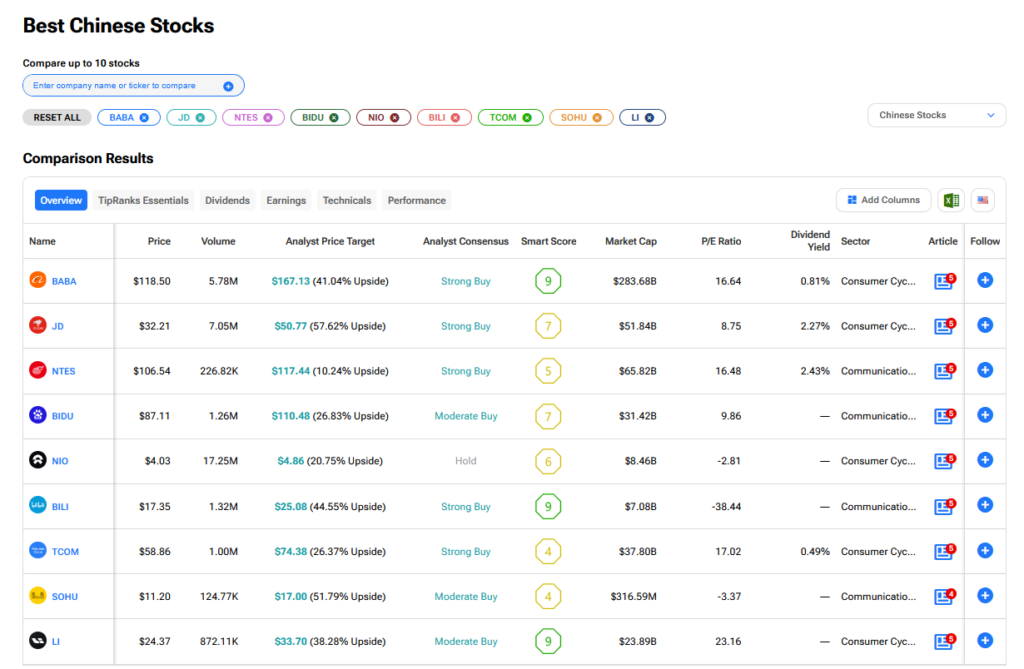

As investors can’t buy shares in Shein, let’s take a look at some other Chinese stocks. A good way of comparing stocks is via this TipRanks comparison chart.