Chinese fast fashion retailer Shein has finally decided to list its shares in the U.S. soon. The valuation at which the company would go public remains unknown, as Shein has confidentially filed for the IPO. The U.S. Securities and Exchange Commission (SEC) will review the filing and suggest necessary changes. Shein’s initial public offering (IPO) could occur sometime in 2024.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The listing is expected to increase Shein’s global footprint and allow it to tap the public markets of one of the world’s largest economies. Shein has roped in Goldman Sachs (NYSE:GS), JPMorgan (NYSE:JPM), and Morgan Stanley (NYSE:MS) as the lead underwriters on the offering. The final paperwork and valuation will be revealed to the public upon approval from the SEC.

Shein Seeks to Capture the American Market

In May of this year, rumors about Shein’s plans to list in the U.S. made the rounds. At the time, the fashion company was valued at close to $66 billion. Even so, Shein’s plans were engulfed by a swarm of challenges. Geopolitical concerns, accusations of using forced labor in its supply chain, and stealing designs from its independent artists are some of the issues that Shein faces. The company is even under investigation by the House Select Committee on the Chinese Communist Party. Importantly, Shein’s IPO will also test investor appetite for initial listings, as the capital markets have remained relatively weak this year.

In the meantime, Shein faces stiff competition from another Chinese retailer, Temu.com, and its biggest threat is American e-commerce giant Amazon.com (NASDAQ:AMZN). Shein’s headquarters are in Singapore. To make a name for itself among American consumers, Shein recently partnered with retailer Forever 21. Through this, Shein will offer the latter’s offerings on its website and gain a much-needed offline presence with Forever 21’s worldwide stores.

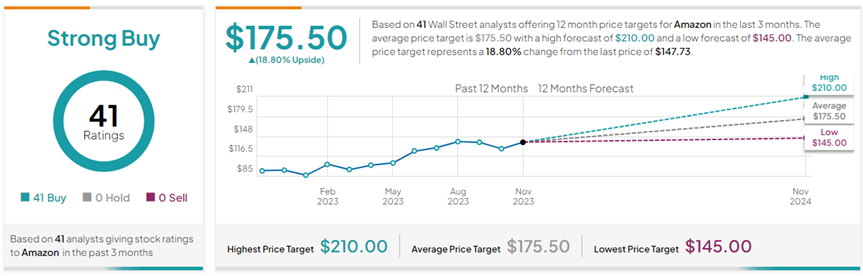

Is Amazon a Good or Bad Stock?

Amazon stock is undoubtedly a good stock, with 41 unanimous Buy ratings on TipRanks. Wall Street has favored its Strong Buy consensus rating on AMZN. The average Amazon.com price target of $175.50 implies 18.8% upside potential from current levels. Year-to-date, AMZN stock has gained 72.1%.