Despite registering a sequential slump in July delivery numbers, shares of all three U.S.-listed Chinese electric vehicle (EV) manufacturers gained on Monday. While Li Auto (NASDAQ: LI) jumped 9.5%, American Depositary Receipts (ADRs) of Nio Inc. (NYSE: NIO) popped 5.2%, and ADRs of XPeng (NYSE: XPEV) rose 3%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Li Auto’s Deliveries Leap 21%

Li Auto, a leader in China’s new electric vehicle (NEV) market, delivered 10,422 Li ONEs (a six-seat, large premium smart electric SUV) in July, up 21.3% year-over-year but lower than June’s 13,024 auto deliveries.

Nonetheless, co-founder and President Yanan Shen was happy to announce the roll-out of the 200,000th Li ONE from the production line of its Changzhou manufacturing base. It was also the fastest-produced 200,000-unit mark in China’s NEV market. Moreover, Li L9, its flagship smart SUV for families, has also received 50,000 orders to date, with over 30,000 non-refundable orders since its launch in June 2021.

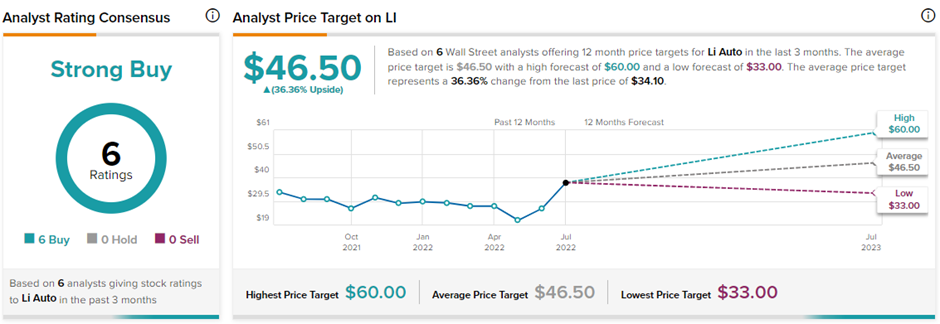

On TipRanks, LI stock commands a Strong Buy consensus rating based on six unanimous Buys. The average Li Auto price target of $46.50 implies 36.4% upside potential to current levels. Meanwhile, LI stock has gained 5.4% so far this year.

Nio’s Deliveries Jump Nearly 27%

Nio Inc., a leader in China’s premium smart EVs, delivered 10,052 vehicles in July, growing 26.7% year-over-year but much lower compared to its June deliveries of 12,961 autos. The deliveries included 7,579 premium smart electric SUVs and 2,473 premium smart electric sedans.

Notably, NIO has delivered 60,879 vehicles so far this year, growing by 22.0% year-over-year. Plus, Nio’s cumulative deliveries as of July end stood at 227,949 EVs.

Nio said that its July production of the ET7 (premium smart electric sedan) and the EC6 (five-seater high-performance premium smart electric SUV) was “constrained by the supply of casting parts,” and that the company was closely working with Chinese suppliers to accelerate production in the following months of the ongoing September quarter.

On TipRanks, NIO stock commands a Strong Buy consensus rating based on ten unanimous Buys. The average Nio price target of $33.66 implies 66.8% upside potential to current levels. Meanwhile, NIO stock has lost 39.7% year-to-date.

XPeng Records Highest July Deliveries

Meanwhile, XPeng Inc., a leader in Chinese smart EVs, delivered the most EVs in July of the three. The company delivered 11,524 vehicles in July, an increase of 43% year-over-year but also lower than the 15,295 autos delivered in June. These include deliveries of 6,397 P7s (smart sports sedans), 3,608 P5s (smart family sedans), and 1,519 G3i (smart compact SUVs).

Remarkably, the EV maker has delivered 80,507 vehicles so far this year, growing a whopping 108% compared to the same period last year, while cumulative deliveries reached 220,000 as of July.

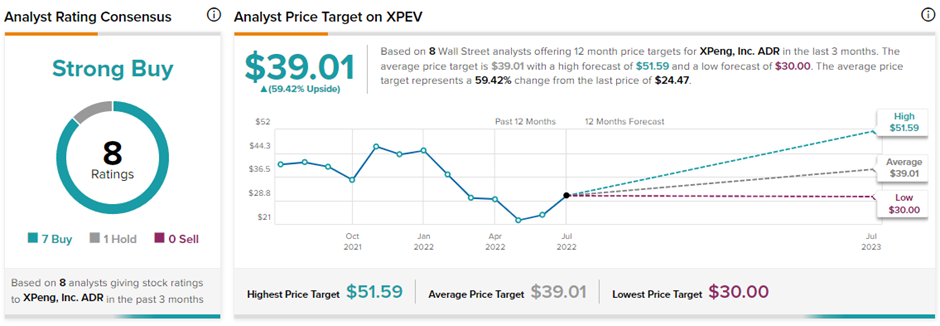

On TipRanks, XPEV stock has a Strong Buy consensus rating based on seven Buys and one Hold. The average XPeng price target of $39.01 implies 59.4% upside potential to current levels. Meanwhile, XPEV stock has lost over 51% so far this year.

Parting Thoughts

The Chinese auto sector and EV sector, in particular, are surfacing from the COVID-19 resurgence-related lock-downs in the first half of the year. Moreover, persistent supply chain issues, shortages of parts, and rising input costs of materials continue to haunt the manufacturers. At such times, it seems that investors are relieved to see year-over-year growth in delivery numbers from the EV makers.