China has responded to the enhanced export restrictions imposed by the U.S. on advanced chips, AI (Artificial Intelligence) technologies, and semiconductor equipment. During the Belt and Road forum in China today, President Xi Jinping announced the launch of a comprehensive artificial intelligence (AI) initiative.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The AI framework outlined by Jinping includes development, security, and governance aspects, emphasizing the creation of a risk-based testing and assessment system. This system is expected to enhance AI’s security and reliability.

A spokesperson for China’s Foreign Ministry said that with the Global AI Governance Initiative, China aims to mutually benefit from AI development and is against forming exclusive groups that look at obstructing other countries from developing AI.

The spokesperson commented, “China stands ready to have exchanges and practical cooperation with all sides on global AI governance.”

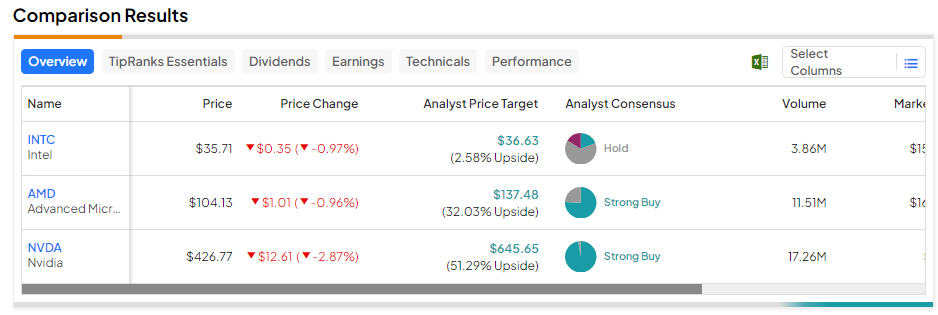

Chip giants, including Nvidia (NVDA), AMD (AMD), and Intel (INTC), were down in morning trading following the news of the curbs.

Wall Street Expresses Concerns over U.S. Export Curbs

Meanwhile, following the news of the export curbs by the United States, Wall Street analysts voiced their concerns about chip stocks. Top-rated Citi analyst Atif Malik, while reiterating a Buy on Nvidia, lowered its price target on the stock to $575 from $630. The analyst’s price target implies an upside potential of 35.4% from current levels.

Explaining his stance, Malik pointed out that the new export restrictions will make it “difficult” for Nvidia to sell its chips to China as it will require further modifications to the company’s A800 and H800 semiconductors.

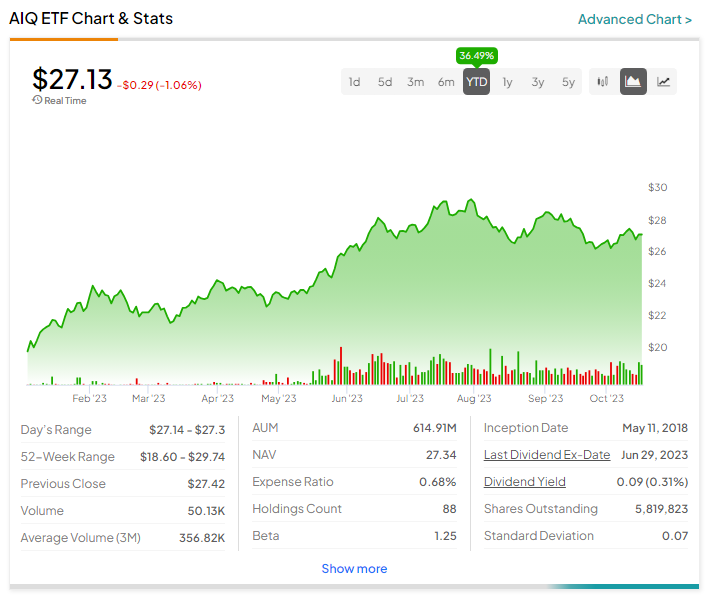

Is AIQ a Good ETF?

The rising interest in artificial intelligence has meant that AI ETFs like the Global X Artificial Intelligence & Technology ETF (AIQ) are attractive investment options for investors. This has resulted in the AIQ ETF going up by more than 35% year-to-date.

Overall, analysts are cautiously optimistic about AIQ ETF with a Moderate Buy consensus rating based on 58 Buys and 30 Holds. The average AIQ price target is $32.72, implying an upside potential of 20.6% from current levels.