The rising political tensions between the U.S. and China have led to China booting U.S. chipmakers from its telecom systems, according to a Wall Street Journal report. The report stated that Chinese officials have asked the nation’s largest telecom carriers to remove essential foreign processors from their networks by 2027.

This move is expected to hit chipmakers AMD (NASDAQ:AMD) and Intel (NASDAQ:INTC) the hardest. It is because these two chip majors have provided the bulk of the core processors used in networking equipment in China and globally. China Telecom and China Mobile are two of the biggest customers of these chip giants.

Moreover, last year, China was one of Intel’s biggest markets, making up 27% of its revenues while the country comprised 15% of AMD’s revenues. The Wall Street Journal cited a report by TrendForce that predicts that Intel will likely grab a 71% market share of the global Central Processing Unit (CPU) market this year, while AMD will hold the remaining 23%.

As the Chinese government moves to restrict foreign chips, Chinese telecom carriers increasingly shift to domestically manufactured chips as the chip quality has improved and their performance is more stable.

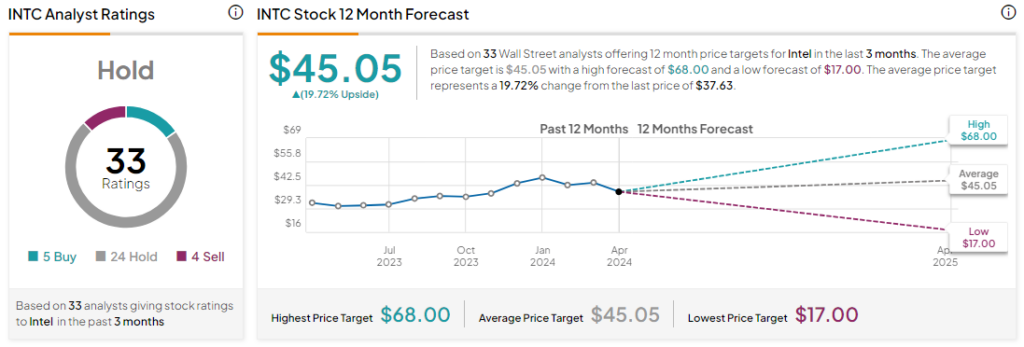

Is Intel a Buy, Sell, or Hold?

Analysts remain sidelined about Intel stock, with a Hold consensus rating based on five Buys, 24 Holds, and four Sells. INTC stock has had a rough run year-to-date, declining by more than 20%. The average INTC price target of $45.05 implies an upside potential of 19.7% from current levels.