Chevron (NYSE:CVX) has recently received authorization from the U.S. Treasury Department to resume oil production in Venezuela. Despite getting this permission, the energy giant is unlikely to increase the global oil supply soon as it has to take on maintenance work for machinery and oil fields.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Furthermore, Chevron is required to collect the debt from the state-run oil company, Petróleos de Venezuela SA (PdVSA), before making any investment in new fields. The debt relates to Chevron’s share of profits from oil sales after the 2020 U.S. sanctions, which made it halt all drilling activities in the area.

The debt collection may take about two to three years. The debt is related to Chevron’s share of oil sales profits following the 2020 US sanctions, which forced it to halt all drilling activities in the area.

While the license approval comes as a win for Chevron, it also necessitates careful supervision by the officials. The corporation is required to disclose information about its operations for the sake of transparency.

Should You Buy CVX Stock?

Chevron stock has gained nearly 60% year-to-date, but the rally seems to have made the stock expensive. It is currently trading at a P/E ratio of 10.5x, compared with the sector’s median average of 8.88.

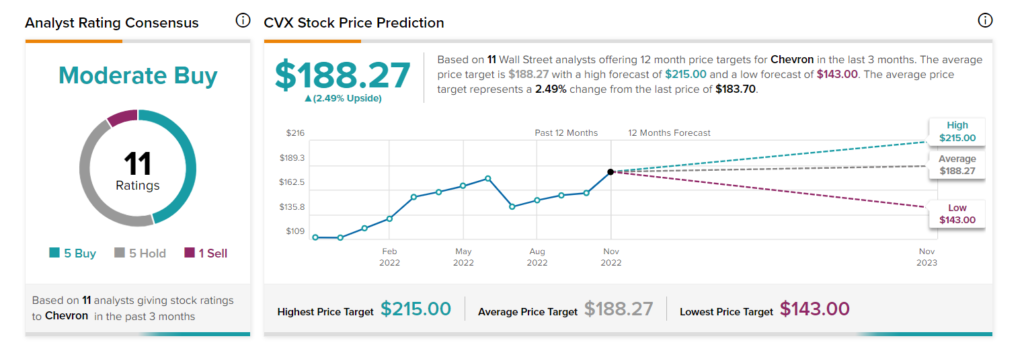

Also, Wall Street is cautiously optimistic about the stock. Chevron’s Moderate Buy consensus rating is based on five Buys, five Holds, and one Sell. The average CVX stock price target of $188.27 suggests a modest upside potential of 2.49%.