Energy giant Chevron (NYSE:CVX) could soon win the Biden administration’s approval to resume drilling activities in Venezuela, provided talks between the Venezuelan government, led by President Nicolás Maduro, and the opposition resume. As per Reuters, which cited people familiar with the matter, the U.S. treasury could grant Chevron a new license as early as Monday or Tuesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Venezuela has been under U.S. sanctions for several reasons, including terrorism, drug trafficking, its anti-democratic stance, human rights violations, and corruption. In 2019, former U.S. President Donald Trump’s administration imposed stringent oil sanctions on Venezuela as part of its efforts to oust Maduro.

Chevron, along with the state-run oil company, Petróleos de Venezuela SA (PdVSA), operates several joint ventures that drill and process crude oil in Venezuela for export. The Biden administration’s potential move to ease the oil sanctions comes at a time when the global oil supply is tight due to the Russia-Ukraine war, a slowing shale production rate, and the possibility of further production cuts by OPEC+.

In October, the Wall Street Journal reported that the U.S. is contemplating easing restrictions on Venezuela. However, back then, a White House spokesperson declined the news saying that the administration had no such intentions until Maduro took steps to regain democracy in the country.

What is the Price Target for Chevron?

Chevron stock has rallied nearly 60% year-to-date, thanks to high oil prices. The stock is one of the top holdings of Warren Buffett’s Berkshire Hathaway.

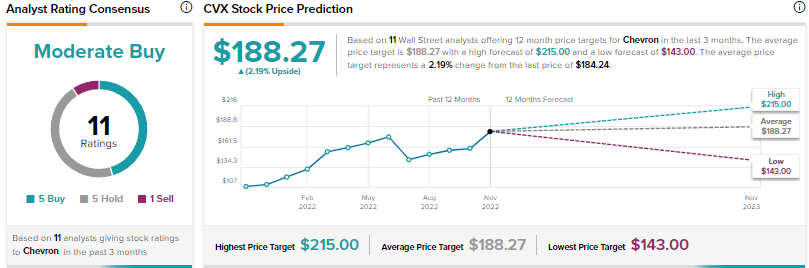

Wall Street’s Moderate Buy consensus rating for Chevron stock is based on five Buys, five Holds, and one Sell. The average CVX stock price target of $188.27 suggests a modest upside potential of 2.2%.