Energy giant Chevron (NYSE:CVX) is in talks with Algeria to strike an energy exploration deal, the Wall Street Journal reported. The company has recently resumed talks with the North African country and sent its representatives in government relations, security, and business development to meet Algerian officials in the past two months.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Chevron Looks for Growth in Algeria

Additionally, Chevron has hired consultants to review the country’s shale and non-shale gas resources and contractual terms. In 2020, Chevron signed a memorandum of understanding with the state-run company Sonatrach to assess natural-gas opportunities in the country. However, the company did not make much progress after that up until now.

Chevron expects to leverage the expertise it developed in the U.S. shale to explore similar reserves in Algeria. “Algeria holds a world-class petroleum system with significant potential for conventional and unconventional oil-and-gas exploration,” said a Chevron spokeswoman.

Chevron is also pursuing opportunities in other lucrative markets. Last month, the company, along with Italian energy group Eni (DE:ENI), announced a new gas discovery in an Egyptian offshore field in the Eastern Mediterranean sea.

Meanwhile, Algeria intends to capture opportunities to replace sanctioned Russian supplies in Europe. According to Reuters, Algerian supplies now account for over one-fourth of the gas demand in Spain and Italy. It’s worth noting that Algeria holds the world’s third-largest recoverable shale resources worth 707 trillion cubic feet, based on Energy Information Administration estimates. While the country is behind China and Argentina, it is ahead of the U.S., which has 623 trillion cubic feet of resources.

Is CVX a Good Buy?

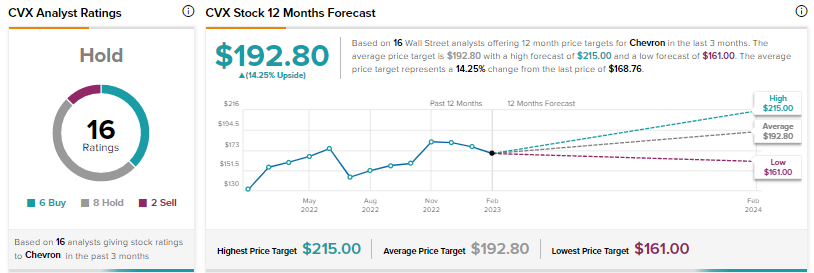

Following a solid rally last year, Chevron stock is down over 2% in 2023 as of writing. Wall Street’s Hold consensus rating for Chevron stock is based on six Buys, eight Holds, and two Sells. The average CVX stock price target of $192.80 implies 14.3% upside potential.