Oil and gas company Chevron (CVX) is set to release its first quarter 2025 financials on May 2. The stock is down over 5% year-to-date, pressured by falling oil prices, weak refining margins, and uncertainty around the Hess deal. With U.S. crude slipping below $60 a barrel amid recession fears, investors will watch closely for management’s outlook on energy demand and the broader macro environment.

Wall Street analysts expect the company to report earnings per share of $2.16, representing a 26% decrease year-over-year. Meanwhile, revenues are expected to slightly increase by 3% from the year-ago quarter to $48.25 billion, according to data from the TipRanks Forecast page.

Analysts’ Views Ahead of CVX’s Q1 Earnings

Ahead of Chevron’s Q1earnings, Redburn-Atlantic analyst Peter Low downgraded the stock to Sell from Neutral and reduced the price target to $124 from $156 per share. The analyst noted that Chevron stock is the most oil price-sensitive among the supermajors, prompting him to lower his price target. While there are some positives ahead, such as the expected completion of the Hess acquisition and a free cash flow boost from the Tengiz project, Low believes these positives may be overshadowed by broader headwinds.

In terms of geography, Chevron’s net oil-equivalent production in Q4 2024 was approximately 1.65 million barrels per day (MBOED) in the United States and 1.7 million barrels per day internationally, according to Main Street Data.

Here’s What Options Traders Anticipate

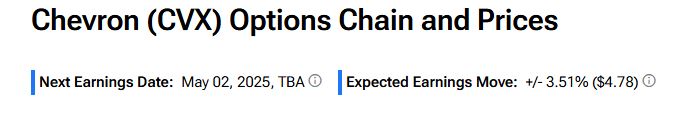

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 3.51% move in either direction in CVX stock in reaction to Q1 results.

Is CVX Stock a Buy?

The stock of Chevron has a consensus Moderate Buy rating among 16 Wall Street analysts. That rating is based on nine Buy, six Hold, and one Sell recommendations assigned in the past three months. The average CVX price target of $163.86 implies 20.43% upside from current levels.