Yesterday, we saw that bank stock Charles Schwab (NYSE:SCHW) lost quite a bit of ground. Why? No one was sure at the time. There were several possible explanations, but none of them seemed to be just right. Now, the sell-off looks like it’s still going on, as Schwab shares lost another 8% in Friday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

So what is going on with Schwab? Well, yesterday, some thought that the possibility of a block sale routed through JPMorgan (NYSE:JPM) was to blame. Others thought a negative halo effect was in progress thanks to trouble seen at SVB Financial Group (NASDAQ:SIVB). The troubles at SVB are still going on; the FDIC shut the bank down earlier today. This was the first time the FDIC took over a bank since the global financial crisis of 2008.

However, some think that the problem is simply a massive overreaction to conditions on the ground. Michael Cyprys, an analyst with Morgan Stanley, calls the hit to Charles Schwab a “…knee-jerk reaction that compounds on long-simmering concerns about cash sorting…” Yet Cyprys welcomes this sell-off, suggesting that the result is now a “…compelling entry point…” for potential investors to get in on a solid stock.

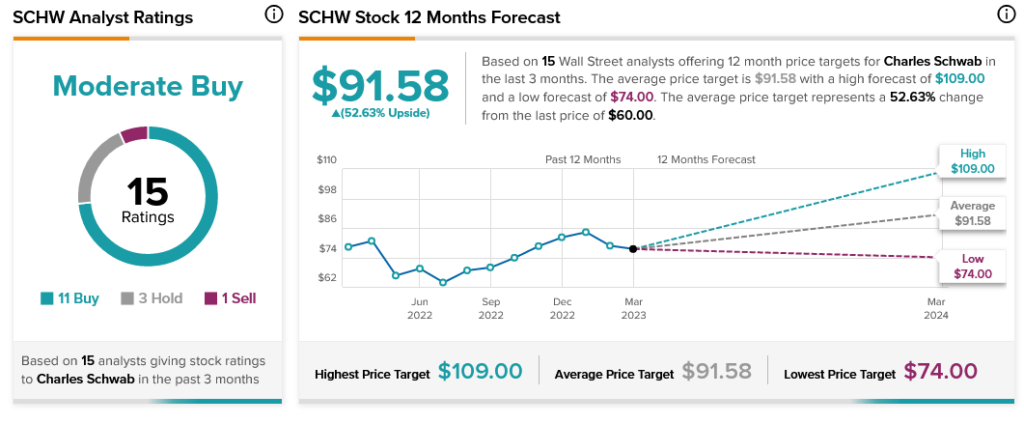

Indeed, Wall Street is very much in Charles Schwab’s corner. Analyst consensus calls Schwab stock a Moderate Buy, with Buy recommendations outpacing all others nearly three to one. Plus, it offers 52.63% upside potential by virtue of its $91.58 average price target.

How can investors see the warning signs of a company at risk? Join TipRanks’ webinar to learn more.