A bit of a mystery emerged around Charles Schwab (NYSE:SCHW), and it didn’t do the bank stock any favors as it lost nearly 13% in Thursday’s trading. This is all thanks to a report that emerged about a potential block sell-off of Schwab stock. Reports noted that the sell-off in question was being run through JPMorgan (NYSE:JPM) and amounted to somewhere around 8.5 million shares.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Said shares came with a price tag between $73 and $74 each. That represented a slight discount over the price seen at this morning’s opening. The seller wasn’t publicly disclosed, but some noted that Schwab’s February numbers were set to release on Tuesday, which might have explained some of the urge to sell.

Also potentially explaining the big drop for Schwab were the results posted by SVB Financial Group (NASDAQ:SIVB). SVB lost around half of its value at one point, especially when it noted it was planning to put out $1.25 billion in new stock so that it could slow its cash burn rate. That had a limited contagion effect go throughout a swath of bank stocks as a whole. Keefe, Bruyette & Woods’ head of trading, R.J. Grant, revealed that “A lot of institutional investors don’t feel great about owning certain banks right now.”

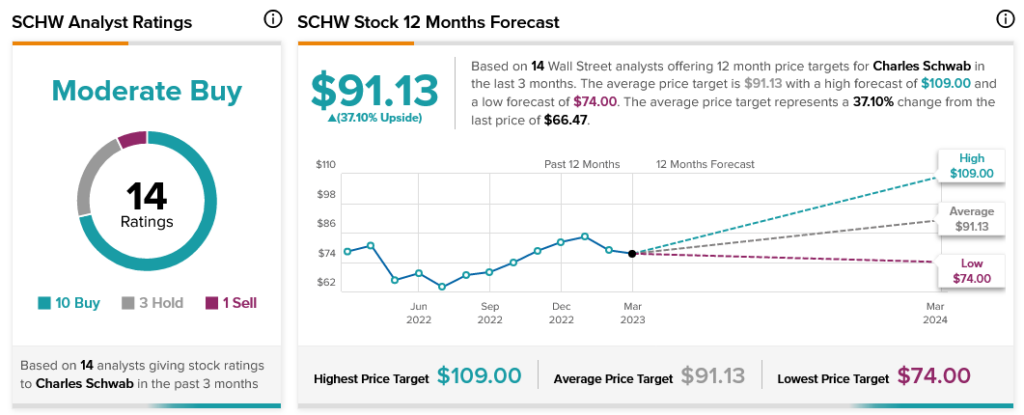

Yet even with this substantial loss, analysts are still supporting Charles Schwab, at least to some degree. Analyst consensus currently calls Schwab stock a Moderate Buy. Plus, thanks to an average price target of $91.13, Schwab stock has 37.10% upside potential.

How can investors see the warning signs of a company at risk? Join TipRanks’ webinar to learn more.