Backed by a solid performance across all key metrics, the third-quarter results for Cerner Corporation (CERN) exceeded expectations, pushing shares up 5.1% to $74.29 on October 29.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The healthcare information technology, devices, and services provider’s adjusted earnings per share (EPS) increased 19% year-over-year to $0.86 per share, 4 cents higher than analyst estimates.

Similarly, revenue came in at $1.47 billion, a year-over-year increase of 7%, surpassing Street estimates of $1.45 billion.

Commenting on the results, Mark Erceg, Executive Vice President and CFO of Cerner, said, “The organizational transformation and productivity measures implemented earlier this year and additional on-going product focus and cost control initiatives are strengthening our business. A clear focus on cash generation is also having a positive impact as evidenced by a 32% increase in Free Cash Flow (non-GAAP) for the quarter.”

Based on the current business momentum, Cerner expects Q4 revenue to grow by upper mid-single digits compared to Q4 2020, and adjusted earnings to increase by 10%-13% year-over-year. (See Insiders’ Hot Stocks on TipRanks)

Meanwhile, revenue is expected to grow by 5% annually, for the full fiscal year 2021, and adjusted earnings are projected at around $3.30 per share. Additionally, CERN projects free cash flow (non-GAAP) of $950 million in FY21 and a total share buyback of up to $1.5 billion.

In response to Cerner’s financial performance, Barclays analyst Steven Valiquette maintained a Hold rating on the stock with a price target of $79, implying 6.3% upside potential to current levels.

Overall, the stock has a Moderate Buy consensus rating based on 5 Buys, 4 Holds, and 1 Sell. The average Cerner price target of $84.70 implies 14% upside potential to current levels. Shares have gained a modest 3.4% over the past year.

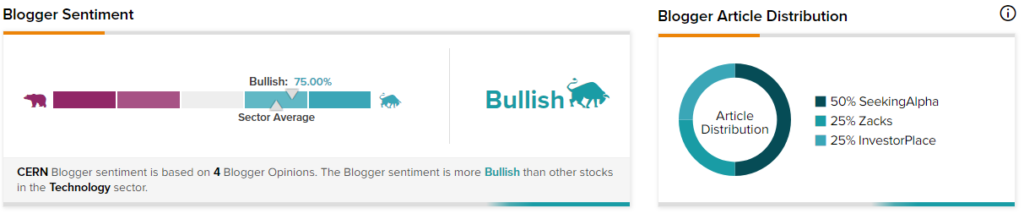

Additionally, TipRanks data shows that financial blogger opinions are 75% Bullish on CERN, compared to a sector average of 70%.

Related News:

Caterpillar Jumps 4% on Q3 Outperformance

Western Digital Plunges 10% After-Hours Despite Solid Q1 Beat

Yum! Brands Delivers Outstanding Q3 Results

5 Top Dividend Stocks for November 2021