Central Banks are known to take actions that trigger reactions from astute investors. This makes sense, as these powerful institutions play a crucial role in driving economic activity within their own countries and abroad. One recent trend is the ongoing accumulation of gold by central banks. This trend has contributed to gold reaching heights it never had before seen.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

They’re essentially buying gold, which increases demand while taking it off the market. This reduction in available supply, coupled with increased demand, creates conditions for price hikes across various commodities. So it’s no wonder the price is breaking records. Investors might not care much about why central banks are buying gold, but they do understand that it’s happening regularly and could affect their investment portfolios.

Below, we delve into the reasons behind this gold-buying spree, the implications for investors, and how it can affect self-directed investors.

Central Banks’ Years of Accumulating Gold

Over the past few years, central banks have been accumulating gold at an unusually brisk pace. According to the World Gold Council, central banks globally have purchased gold at a pace not seen since 1967.

Reportedly, in the first two months of 2023, central banks collectively bought a net 125 tonnes of gold, the strongest start to a year since at least 2010.

What’s Driving Central Banks’ Gold Purchases?

Investors should know what’s driving gold accumulation by central banks. There are several explanations why central banks are turning to gold, and it’s important to know that these reasons may vary across institutions.

One of the primary drivers is geopolitical tensions and economic uncertainties. As challenges continue to surface (think pandemic, military conflict, corruption, alternative currencies, etc.) for the central bankers, gold is still seen as a universal safe haven asset that can help to diversify their reserves, reducing risk.

Some nations moving away from the U.S. dollar as a reserve currency has also fueled the demand for gold. Major bond rating agencies, such as Standard & Poor’s, Fitch, and Moody’s, have all taken actions indicating concerns about the stability of U.S. Treasury debt. This includes downgrades by Standard & Poor’s in 2011, Fitch’s downgrade in late 2023, and Moody’s placing the U.S. Treasury on credit watch for a potential downgrade in November of the same year.

Central banks that heavily invested their reserves in U.S. dollars typically favored liquid Treasuries for earning interest. However, these securities are now perceived as less secure. Central banks are thus compelled to diversify their holdings.

Gold Prices and Investment Opportunities

The increased demand for gold from central banks has had a significant impact on gold prices. The price of spot gold broke records as it reached over $2,407 per ounce this week, driven by central banks, investors riding on their momentum, and those seeking safe-haven assets.

This upward trend in gold prices presents opportunities for investors in gold-related stocks. Companies involved in gold mining, exploration, and trading could see increased profits as gold prices rise.

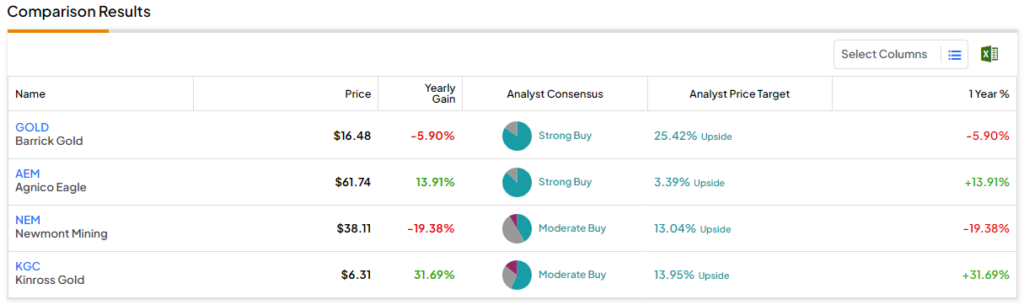

A quick look at the TipRanks Comparison Tool results for gold-related stocks uncovers three of four stocks with Analyst Price Targets above 10% within the next year.

Navigating the Gold Market as an Investor

For investors looking to capitalize on rising gold prices, gold-related stocks offer a way to gain exposure to the gold market without physically owning gold.

However, it’s important to remember to conduct thorough research and carefully consider the risks involved. This is because the performance of gold-related stocks can be influenced by factors beyond gold prices, such as operational efficiency, management decisions, and geopolitical events.

Investor Takeaway

To summarize, the continuous gold buying by central banks has been a significant driver of the rising price of gold we’ve seen in recent years. This trend is expected to continue, providing opportunities for investors in gold-related stocks.

However, as with any investment, it’s important to carefully consider the risks and conduct thorough research before plunging into any investment decisions.