This month, Zimbabwe introduced a new gold-backed currency, called the ZiG (Zimbabwe Gold). This marks Zimbabwe’s sixth attempt at introducing a stable and credible currency.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Zimbabwe’s Endeavour Towards Currency Stability

The new currency is backed by gold as well as Zimbabwe’s foreign currency reserves. Over the years, Zimbabwe has endured the perils of rampant inflation. In 2008, the country experienced inflation rates soaring as high as 500 billion percent, leading its central bank to print one-hundred-trillion-dollar notes. More recently, the Zimbabwe dollar has depreciated by nearly 80% in value against the U.S. Dollar.

This week, the ZiG commenced trading at an exchange rate of approximately 13.56 to the USD. Following this, the exchange rate will be allowed to float freely. This significant change has prompted local institutions and businesses to reconfigure their systems to accommodate the new currency. Additionally, the share prices of all listed companies in the country are being rebased.

Zimbabwe’s central bank is supporting the new currency with $100 million in cash reserves and gold reserves totaling around 2,522 kilograms. The circulation of new banknotes in the country expected to commence on April 30.

Various Challenges May Arise

Nevertheless, persuading the populace to adopt the new currency may pose a significant challenge. To stimulate demand, the government intends to mandate that firms settle at least half of their tax obligations using the new currency. Currently, the ZiG is anticipated to coexist with other currencies in circulation within the country, with the USD expected to remain the preferred choice for many Zimbabweans in the short term.

Are Gold Prices Expected to Go Up?

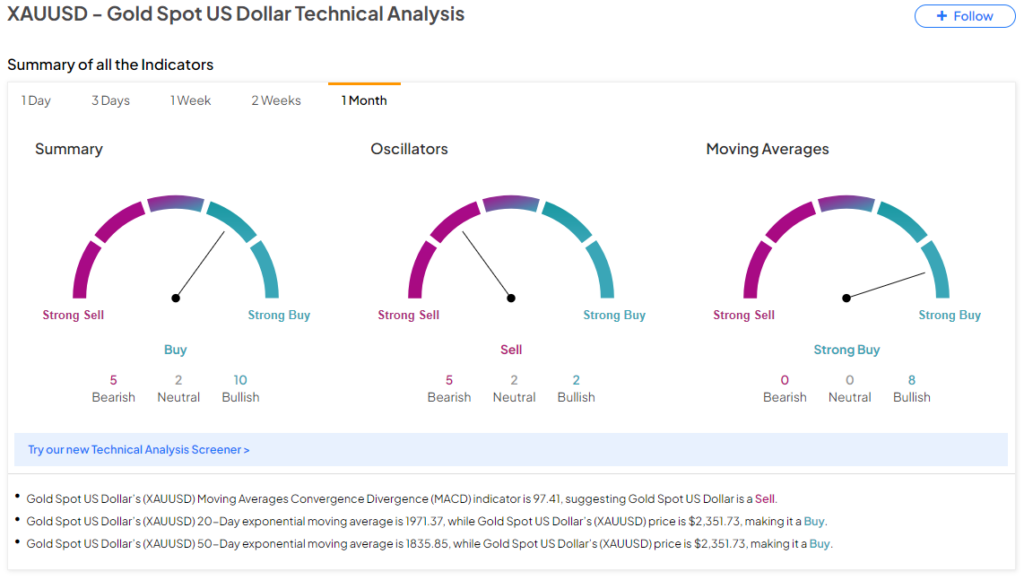

At the same time, the developments in Zimbabwe highlight the age-old faith in gold as a store of value. Over the past 52 weeks, the yellow metal has surged by nearly 17% due to steady buying by central banks and safe-haven demand, which continue to support prices. While gold is now hovering at multi-year highs, the TipRanks Technical Analysis tool is flashing mixed signals, implying caution may be warranted before initiating new positions in gold.

Ready to ‘commodi-tize’ your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure