Breast cancer is the most frequently diagnosed cancer worldwide. Currently, about 4 million American women are living with breast cancer, with over 150,000 battling metastatic disease. The 5-year survival rate for localized breast cancer is significantly high, at 99%. However, for metastatic disease, it comes down to 29%. Celcuity (NASDAQ:CELC) aims to improve those numbers with its lead treatment candidate, currently entering Phase 3 trials. If successful, it could be a game-changing biotech with blockbuster potential.

Celcuity stock is up 98.6% over the past year. Given the upside potential, the stock warrants consideration from biotech investors.

Potential Blockbuster Drug

Celcuity is a clinical-stage biotechnology company focused on developing targeted therapies to enhance the clinical outcomes of cancer patients. The company’s lead treatment candidate, Gedatolisib, is making notable progress.

The company is currently exploring the use of Gedatolisib for the treatment of patients with hormone receptor-positive, HER2-negative, advanced, or metastatic breast cancer. The drug has entered a Phase 3 registration-enabling clinical trial to assess Gedatolisib in patients with HR+/HER2- advanced breast cancer. The company anticipates sharing preliminary data from this trial in early 2025.

Current estimates for the target population are roughly 100,000 breast cancer patients globally per year, and the need for HR+/Her2 treatments is expected to witness significant growth. The current market value of approximately $9 billion is expected to expand with a CAGR of 9.3% by 2032.

Financial Outlook

Like most clinical-stage biotech companies that have yet to bring a treatment to market, Celcuity operates at a net loss as it allocates capital towards research and development (R&D) efforts. The company recently posted Q4 and FY2023 financial results, reporting a net loss of $18.8 million, or -$0.65 per share. This was an increase from the net loss of $11.6 million, or -$0.69 loss per share, for the same period in the previous year. For 2023, the net loss totaled $63.8 million, or -$2.69 loss per share, up from the net loss of $40.4 million, or -$2.64 loss per share, in 2022.

The rate at which a biotech startup spends cash, or its “burn rate,” is a critical metric for investors to monitor. The net cash used in operating activities in Q4 2023 was $18.5 million, up from $9.5 million in Q4 2022. For the full year 2023, $53.8 million of net cash was used for operating activities, a significant increase from the $36.0 million in the prior year.

However, Celcuity’s cash reserves, including cash equivalents and short-term investments, stood at $180.6 million as of December 31, 2023. This is expected to be sufficient to finance operational activities into the first half of 2026.

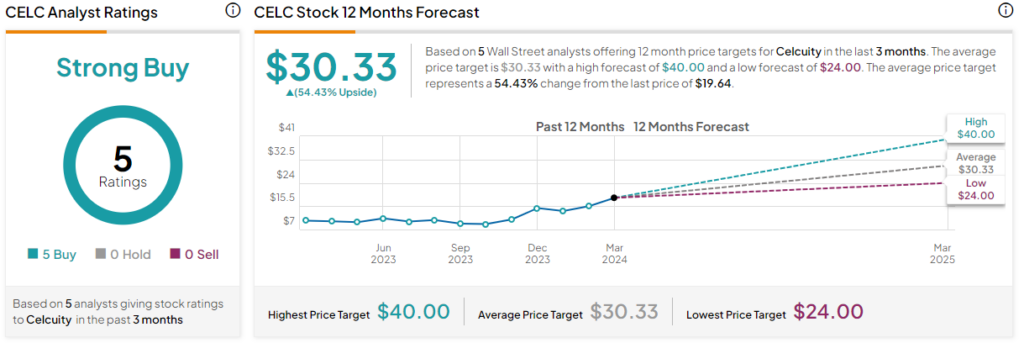

What Is the Price Target for CELC?

Celcuity stock has been trending up, climbing 98.61% over the past year, and currently trades towards the upper end of its 52-week price range of $8.39-$22.19. It continues to demonstrate upward price momentum, trading above its 20-day (17.87) and 50-day (16.62) moving averages.

Analysts covering the company are bullish on the stock. For instance, Stifel analyst Bradley Canino recently initiated coverage with a Buy rating and assigned the stock a price target of $40. He cited the “blockbuster” market potential for Gedatolisib based on the strength of data from previous phases of clinical trials.

Celcuity stock is rated a Strong Buy based on the ratings and 12-month price targets assigned by five Wall Street analysts in the past three months. The average price target for CELC stock is $30.33, representing a 54.43% upside potential from current levels.

Final Analysis on Celcuity

In a battle against the world’s most frequently diagnosed cancer, Celcuity is poised to make significant strides if its groundbreaking treatment candidate successfully clears clinical trials. With its potential to significantly improve survival rates for advanced breast cancer patients and other conditions like mCRPC, Gedatolisib could be an industry-changing blockbuster drug. Further, the upside potential makes CELC an attractive biotech stock for investors.