Shares of Carnival (CCL) rose after the company reported third-quarter earnings that exceeded analyst expectations, fueled by strong demand and higher pricing. The cruise operator posted adjusted net income of $2.0 billion, or $1.43 per share, surpassing estimates of $1.32. Notably, CEO Josh Weinstein described the quarter as “phenomenal,” highlighting that Carnival delivered all-time high net income. Following the results, CCL stock is up 1.04% as of this writing on Monday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Carnival is the world’s largest cruise operator, offering vacations across multiple brands and destinations.

Carnival Posts Record Revenue

In Q3, Carnival reported record revenue of $8.2 billion, beating the consensus estimate of $8.09 billion and marking the tenth consecutive quarter of all-time high revenues. Meanwhile, net yields in constant currency also surpassed June guidance, driven by strong close-in demand. Here, net yields refers to the average revenue earned per available passenger, after discounts and adjustments.

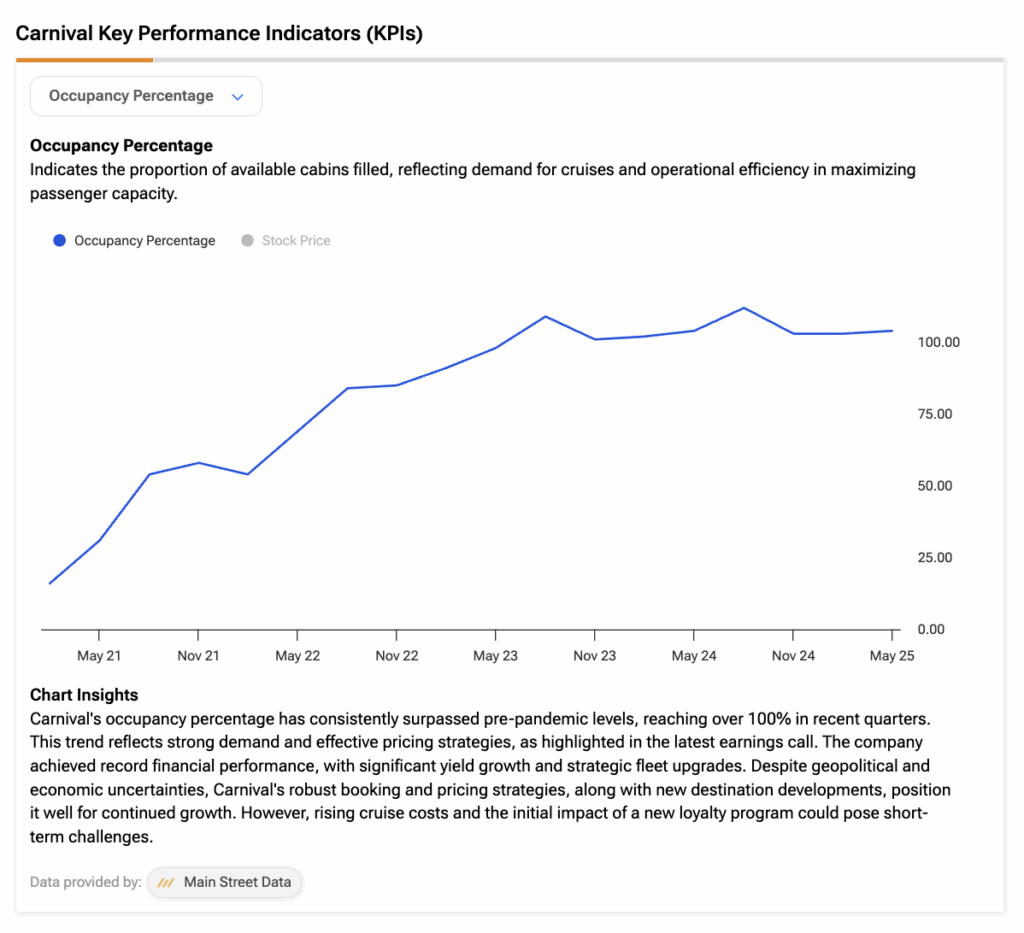

Additionally, occupancy percentage remained strong at 112% for the quarter, unchanged year-over-year. Below is a screenshot showing Carnival’s occupancy percentage growth over the years.

Carnival Raises 2025 Outlook

Looking ahead, advanced bookings for 2026 remain strong, matching 2025’s record levels and reflecting historically high prices in constant currency.

The company raised its full-year 2025 outlook for the third time this year. The company now expects adjusted net income to climb nearly 55% versus 2024, which is $235 million higher than its prior (June) guidance. For the fourth quarter, Carnival forecasts net income to grow more than 60% compared to Q4 2024.

Is Carnival a Good Stock to Buy?

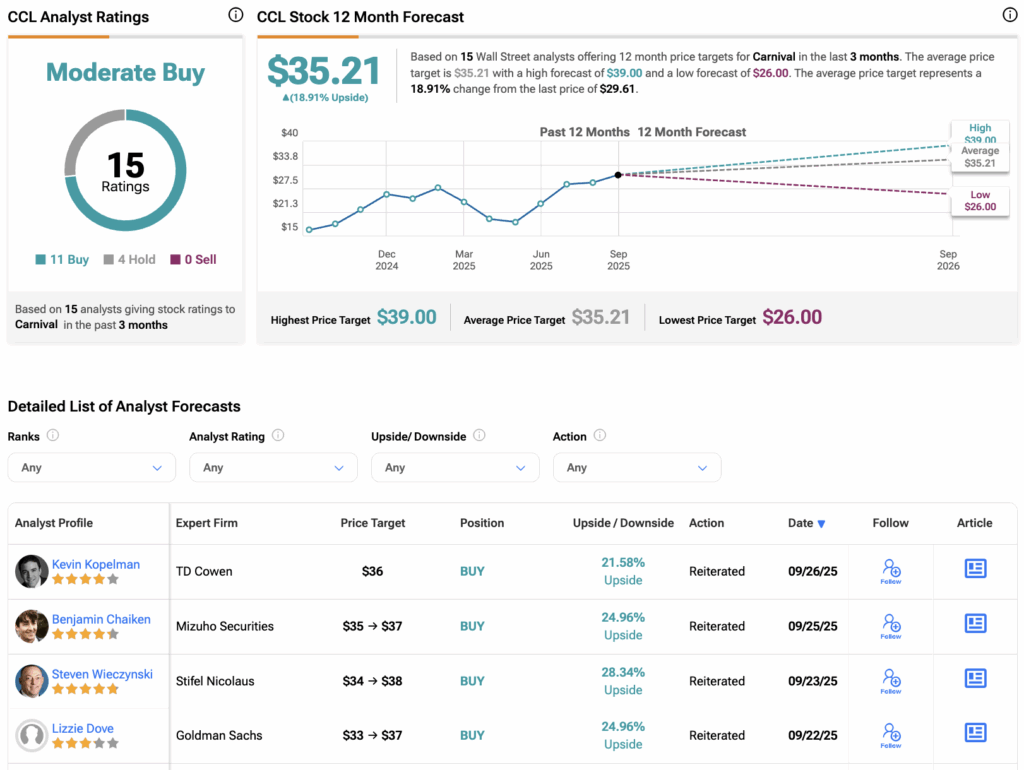

According to TipRanks’ consensus, CCL stock has a Moderate Buy consensus rating based on 11 Buys and four Holds assigned in the last three months. At $35.21, the average stock price target of Carnival implies a 18.91% upside potential.