Dividend-paying stocks offer a great way to generate income along with potential capital appreciation. Thus, investors seeking steady income could consider companies with a high dividend yield. Using the TipRanks Stock Screener tool, we have identified two stocks – Crown Castle (NYSE:CCI) and Pfizer (NYSE:PFE). These stocks offer a dividend yield of more than 5% and have an upside potential of more than 15%.

Let’s take a closer look at these two stocks.

Is CCI a Good Stock?

Crown Castle provides shared communications infrastructure, including cell towers, fiber optic networks, and small cell solutions. The stock has a dividend yield of 6.09%, far more than the real estate sector’s average of 3.91%.

The company’s growing revenues are a sign that its efforts to expand its Fibre division are beginning to pay off. Furthermore, it is anticipated that the company’s performance will improve going forward due to an increase in domestic site leasing activity.

Crown Castle has received four Buy and eight Hold recommendations for a Moderate Buy consensus rating. Further, analysts’ average price target on CCI stock of $120.55 implies a 17.99% upside potential. The stock has gained 17.7% over the past six months.

Is Pfizer a Buy, Sell, or Hold?

Pfizer is a multinational pharmaceutical company that develops and manufactures medications, vaccines, and consumer healthcare products. Interestingly, the stock has a dividend yield of 5.95%, compared with the healthcare sector’s average of 1.5%.

With the acquisition of Seagen (completed in December 2023), PFE strengthened its presence in the high-growth oncology market. Additionally, the company’s focus on developing non-Covid products positions it well for long-term growth.

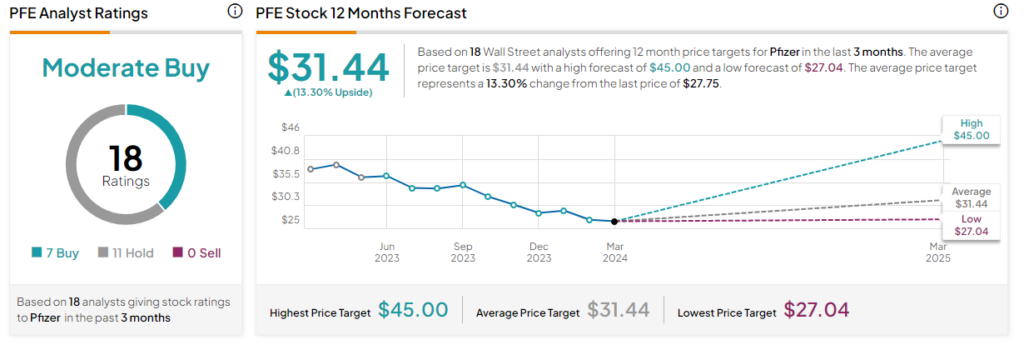

PFE has received seven Buy and 11 Hold recommendations for a Moderate Buy consensus rating. Further, analysts’ average price target on Pfizer stock of $31.44 implies 13.3% upside potential. The stock has lost 16% over the past six months.

Concluding Thoughts

High dividend yields, robust cash flows, and strong growth prospects make PFE and CCI worth considering by investors. Further, the upside potential projected by Wall Street analysts in these stocks is another encouraging factor.