Cathie Wood’s ARK Invest ETFs (exchange-traded funds) have continued to build their position in BYD Company Ltd. (BYDDY) (BYDDF), signaling growing confidence in the Chinese electric vehicle maker. In its latest trade disclosure dated Tuesday, October 21, ARK’s Autonomous Technology & Robotics ETF (ARKQ) purchased 55,523 shares of BYD worth $757,888. This follows a similar buy just a day earlier, when the fund added 69,000 shares of BYD valued at $941,160.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

(Note: To see more of Cathie Wood’s October 20 trades, click here — Cathie Wood Invests $5.5M in Exact Sciences, Trims Stakes in Guardant, Palantir, SoFi, and Other Big Names.)

The recent buys show ARK’s steady interest in BYD stock, driven by rising optimism over China’s EV demand and the company’s global reach. BYD, a key rival to Tesla (TSLA), is rapidly expanding its exports and strengthening its position in hybrid and battery technology.

However, BYD shares have come under pressure lately, sliding after the company announced its largest-ever recall, covering over 115,000 vehicles due to design and battery safety issues. Wood may be buying the dip, reflecting her confidence in BYD’s long-term potential.

Is BYDDF a Good Stock to Buy?

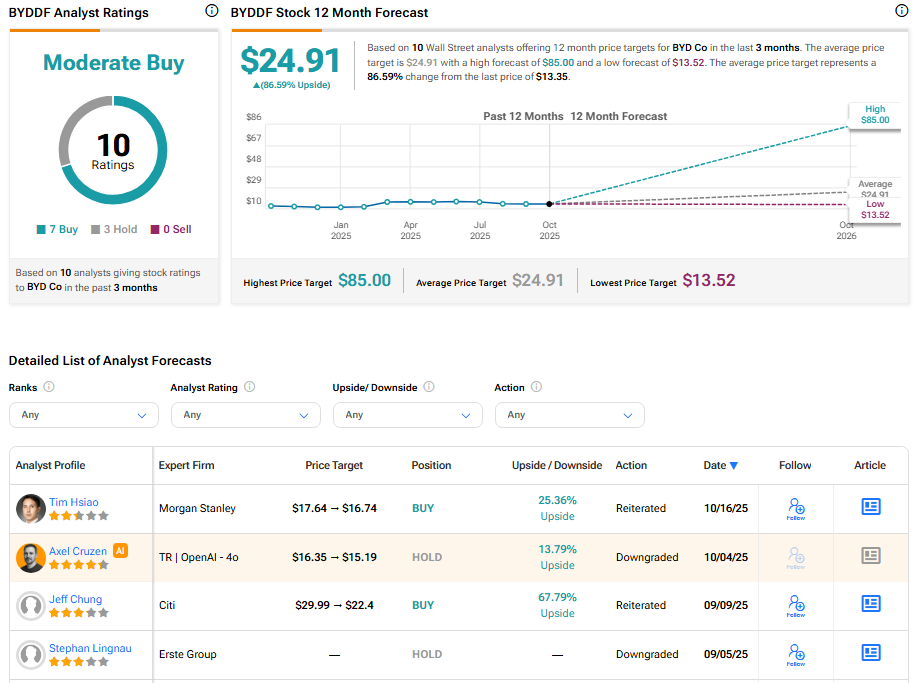

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BYDDF stock based on seven Buys and three Holds assigned in the past three months. At $24.91, the average BYD Co. stock price target implies an 86.59% upside potential. Year-to-date, shares of the company have gained 19.09%.