Caterpillar (CAT) has announced that it has agreed to acquire the Oil & Gas Division of the Weir Group PLC, a Scotland-based global engineering business, for $405 million in cash.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Headquartered near Fort Worth, Texas, Weir Oil & Gas produces a full line of pumps, flow iron, consumable parts, wellhead and pressure control products that are serviced via an extensive global network of service centers located near customer operations.

“Combining Weir Oil & Gas’s established pressure pumping and pressure control portfolio with Cat’s engines and transmissions enables us to create additional value for customers,” cheered Joe Creed, VP of Caterpillar’s Oil & Gas and Marine Division. “This acquisition will expand our offerings to one of the broadest product lines in the well service industry.”

The purchase price of $405 million is to be paid in cash at closing. The acquisition requires approval by Weir shareholders and is subject to review by various regulatory authorities as well as customary closing conditions.

The transaction includes more than 40 Weir Oil & Gas manufacturing and services locations and approximately 2,000 employees.

According to CAT, the acquisition is consistent with its strategy to invest for long-term, profitable growth through expanded offerings and services. “Caterpillar is taking advantage of its strong balance sheet to complete this acquisition that supports the enterprise strategy” the company stated.

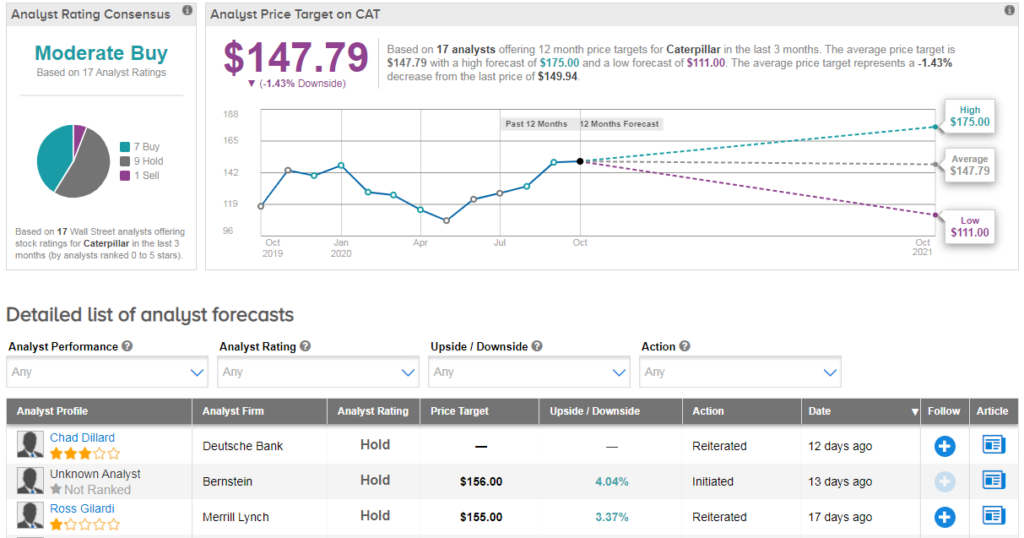

Shares in Caterpillar are trading marginally higher on a year-to-date basis, and the stock scores a cautiously optimistic Moderate Buy Street consensus. However the average analyst price target of $148 indicates 1.4% downside potential from current levels.

Oppenheimer analyst Noah Kaye has a hold rating on the stock with a $140 price target. “We positively view management’s ongoing efforts to mitigate earnings volatility through the cycle and believe CAT is underappreciated as a play on industrial autonomy and connected assets” the analyst wrote recently.

“However, while the Street may not be capturing structurally higher earnings power in the model, in our view, the current valuation fairly does” Kaye told investors, after the company indicated expectations for end-user demand to remain soft in 3Q. (See CAT stock analysis on TipRanks).

Related News:

XPO Revives $4B+ Sale Of European Supply Chain Business- Report

Noble Energy Gets Shareholder Nod For $4.1B Chevron Deal

Global Payments Mulls $2B+ Sale Of Prepaid Card Unit – Report