Noble Energy shareholders have approved the $4.1 billion takeover by energy company Chevron Corp. on Friday. The companies expect to close the deal in the fourth quarter. Noble Energy and Chevron shares rose about 1.4% and 1.1%, respectively.

Chevron (CVX) had agreed to acquire the oil and gas producer Noble Energy in an all-stock deal on July 20. At the time of the deal, the transaction was valued at $5 billion, or $10.38 per share, based on Chevron’s closing price on July 17. Including the debt of $8 billion, the enterprise value was $13 billion, marking it one of the biggest oil deals of 2020. The acquisition value has dropped by almost $1 billion, as oil stocks were hit hard by the coronavirus-induced plunge in in crude demand, Bloomberg reported.

Chevron said in a July report that Noble Energy (NBL) “brings low-capital, cash-generating offshore assets in Israel, strengthening Chevron’s position in the Eastern Mediterranean. Noble Energy also enhances Chevron’s leading U.S. unconventional position with de-risked acreage in the DJ Basin and 92,000 largely contiguous and adjacent acres in the Permian Basin.”

Chevron’s CEO Michael Wirth said “annual run-rate cost synergies of approximately $300 million before tax.” He also expects the deal “to be accretive to free cash flow, earnings, and book returns one year after close.” (See CVX stock analysis on TipRanks).

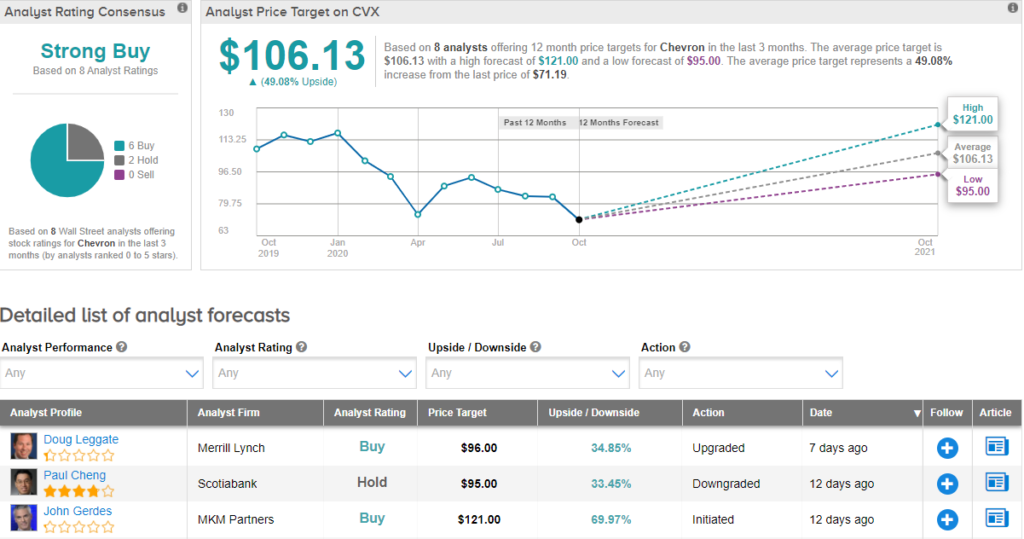

On Sept. 22, Merrill Lynch analyst Doug Leggate upgraded Chevron to Buy from Hold on valuation, saying that the company “has moved back to levels where the risk/reward is attractive.” The analyst maintained a price target of $96 (34.9% upside potential).

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 6 Buys and 2 Holds. The average price target of $106.13 implies upside potential of about 49.1%. Shares have declined 40.9% year-to-date.

Related News:

XPO Revives $4B+ Sale Of European Supply Chain Business- Report

Walmart Inks £6.8B Sale Of UK’s Asda To Issa Brothers, TDR Capital

Global Payments Mulls $2B+ Sale Of Prepaid Card Unit – Report