Casey’s General Stores (NASDAQ:CASY) shares are under pressure in the early session today after the convenience store chain delivered mixed numbers for the third quarter. Revenue remained largely flat at $3.33 billion. The figure lagged expectations by $180 million. EPS of $2.33, on the other hand, came in better than estimates by $0.19.

During the quarter, inside same-store sales increased by 4.1%, and total inside gross profit jumped by 11.3% to $501.5 million. The uptick in CASY’s inside same-store sales was driven by strength in prepared food and dispensed beverage categories. Its same-store fuel gallons, however, ticked lower by 0.4%. Concurrently, total fuel gross profit declined by 2% to $257.2 million.

For Fiscal Year 2024, CASY expects same-store inside sales growth in the 3.5% to 5% range. EBITDA growth for the year is pegged between 8% and 10%. The company plans to open at least 150 stores during the year.

Furthermore, Casey’s has declared a quarterly dividend of $0.43 per share. The CASY dividend is payable on May 15 to the investors of record on May 1.

What Is the Price Prediction for CASY Stock?

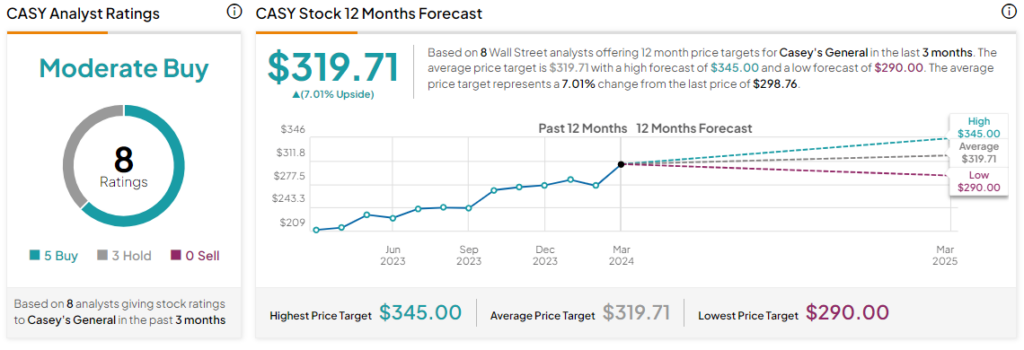

Today’s price decline comes after a nearly 42% rally in the company’s share price over the past year. Overall, the Street has a Moderate Buy consensus rating on Casey’s alongside an average price target of $319.71. However, analysts’ views on the stock could see a revision following its earnings report.

Read full Disclosure