Shares of Instacart (NASDAQ:CART) and DoorDash (NASDAQ:DASH) have been steadily driving higher lately, thanks in part to robust demand for their delivery services and their willingness to invest in their top growth drivers. As the two rebounding delivery plays look to many company-specific improvements, I do not doubt their shares can add to newfound momentum over coming quarters.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Undoubtedly, the two food-delivery firms have won the love of a handful of Wall Street analysts in recent months. Like many analysts continuing to support the two food-delivery juggernauts, I’m staying bullish on CART and DASH, even as competition looks to grow even fiercer from here.

Indeed, it’s not just the improving industry dynamics or secular tailwinds (young consumers prefer to spend money on comfort and convenience) that should excite investors as we move into the second quarter of 2024. Both firms also have plenty of market share to take as they begin to tap into the power of artificial intelligence (AI). Undoubtedly, it’s hard to ignore AI innovations, regardless of which industry you’re looking at.

Though food delivery apps no longer seem nearly as cutting-edge these days (many of us have taken them for granted in the post-COVID-lockdown world), there are many impressive technologies working hard behind the scenes.

While full-self-driving (FSD) delivery vehicles may not be in the cards in the near future, I don’t think investors should throw the delivery apps into the non-innovative category just yet. They have a lot to gain from embracing new tech as they look to drive customer satisfaction higher while unlocking a few efficiencies where they’re to be had.

Therefore, let’s use TipRanks’ Comparison Tool to get a closer look at the two food-delivery app plays and see where analysts stand.

Instacart (NASDAQ:CART)

Instacart didn’t have the most explosive IPO in the world when it went public in September 2023. After a few months of settling to its eventual $22 and change lows, marking a 25% plunge off its opening-day mid-September peak of $30 per share, CART stock is finally starting to pick up traction and praise from some big-name analysts on Wall Street and received a big bet from a massive investor.

Sequoia Capital has been buying more shares of the $9.9 billion grocery-delivery play, an encouraging sign that more upside may be on the horizon. Despite rocketing more than 55% year-to-date, I’m inclined to stay bullish on the firm as it looks to impress in its second year as a publicly-traded company. Indeed, there’s a lot of ground to gain as the firm looks to keep its foot on the gas.

Macquarie’s Ross Compton initiated CART stock with a Buy rating and a $42.00 price target (implying just north of 13% gains from current levels). As a part of his bull thesis, Compton sees Instacart leveraging “its suite of technological tools” to help it grow in a grocery market that’s “still nascent.” Compton is right on the money. Instacart’s tech edge can easily help it gain market share while keeping customers coming back.

Indeed, Instacart is relatively lightweight in the food-delivery app scene, and if it can flex its tech muscles to gain share, the rewards could have the potential to be outsized.

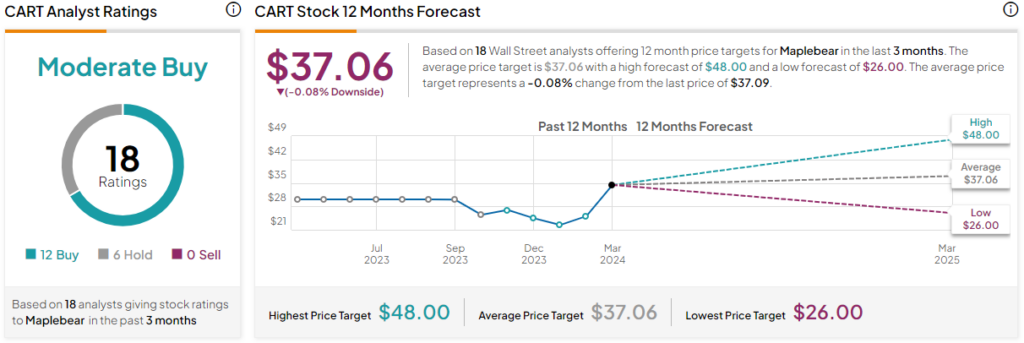

What Is the Price Target for CART Stock?

CART stock is a Moderate Buy, according to analysts, with 11 Buys and six Holds assigned in the past three months. The average CART stock price target of $37.06 implies that shares are fairly valued.

DoorDash (NASDAQ:DASH)

DoorDash is more of a light-heavyweight champ in the food-delivery scene, with its $55.5 billion market cap and catchy marketing campaigns that have won it some loyal users over the years. The stock has also been red-hot, blasting off more than 40% year-to-date and 135% over the past year.

Indeed, it’s tough to envision a firm that could stop the delivery app giant in its tracks. Moving ahead, I’d look for DoorDash to continue gaining market dominance as it embraces new technologies such as AI and drones to drive margins and the customer value proposition higher.

Lately, the company has made quite an early splash with generative AI. Its SafeChat feature monitors communications between drivers and customers to ensure no hostilities can arise. Indeed, missing items and issues can happen in the grocery delivery process. With SafeChat, incidents between drivers and customers can be neutralized before they have a chance to happen.

Additionally, DoorDash has been using AI behind the scenes to improve the driver-customer matching process. Efficient matching continues to be a difficult problem to crack, but it’s one that better AI algorithms can help solve.

Beyond AI, DoorDash is ready to tap into drone deliveries, with the firm recently debuting the service to select markets in the U.S. Undoubtedly, drone delivery may very well allow DoorDash to drive margins well before fully autonomous vehicles even hit the roads.

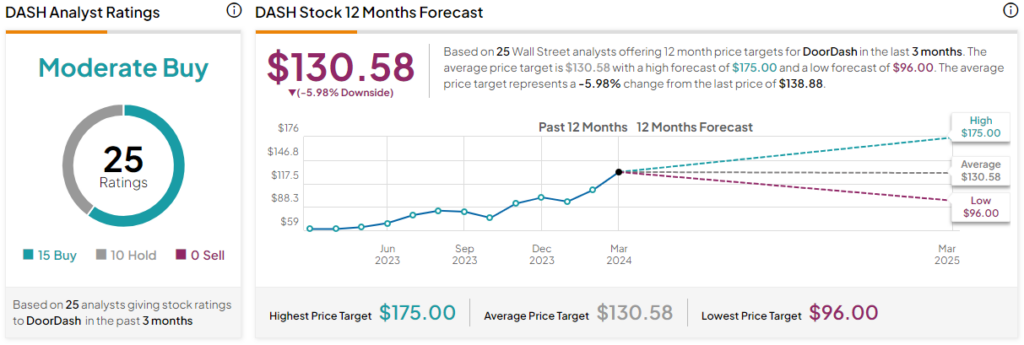

What Is the Price Target for DASH Stock?

DASH stock is a Moderate Buy, according to analysts, with 15 Buys and 10 Holds assigned in the past three months. The average DASH stock price target of $130.58 implies 6% downside potential.

The Bottom Line

When you consider the amount of time saved from using food-delivery apps, it just makes sense to delegate the task to someone at Instacart. As Instacart and DoorDash continue to innovate, whether via AI or drones, I continue to think they’ll gain in share. Of the duo, analysts view Instacart as the slightly better Buy.