For a while there, the entire cruise industry looked like a disaster in the making. After being closed for months on government orders, it then faced ships running aground and ships left in nightmarish conditions that resembled a toilet bowl more than a stately luxury vessel. But now, things are on the mend, and Carnival (NYSE:CCL) is up over 7% in Thursday afternoon’s trading as a result. Carnival’s earnings report told the tale and told it remarkably well. While Carnival still reported a loss of $0.07 per share, that was nearly half of what analysts expected, at a loss of $0.13 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Even with this lower-than-expected loss, Carnival still posted record revenue for the quarter and for the year. The quarter’s revenue came in at a hefty $5.4 billion, while yearly sales were $21.6 billion. That, too, blew expectations away and gave Carnival all the fuel it needed for today’s huge surge. Carnival didn’t rest on its laurels, either; it’s already pulled $4.6 billion off its debt load and has a nice cash cushion of $5.4 billion on hand, as bookings are still strong.

A Shockingly Dynamic Industry

Describing Carnival’s performance over the last few days as “dynamic” is almost understating things. In just the last three days, Carnival has shut down all of its Louisiana ports and opened up new operations in Texas, sponsoring the Houston Livestock Show and Rodeo. That’s the first time that a cruise line has ever partnered with the event, likely because it’s such an incongruous partnership. A cruise line sponsoring a boat show? Sure. A water park? Okay, yeah. But a rodeo? That’s like a lawn mower company sponsoring a jet ski race. There’s no grass here at all! And even as the East Coast saw multiple cruise ship delays, it was clear that Carnival was going to keep right on rolling along, which it’s done ever since government mandates got their boot off Carnival’s throat.

Is Carnival a Buy, Sell, or Hold?

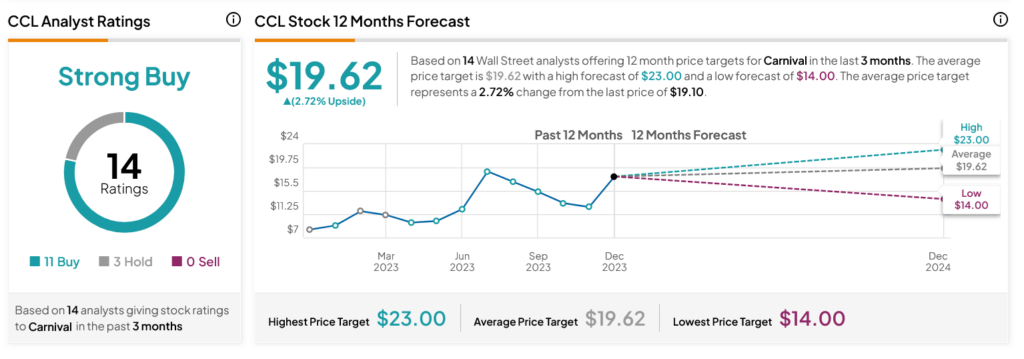

Turning to Wall Street, analysts have a Strong Buy consensus rating on CCL stock based on 11 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 146.45% rally in its share price over the past year, the average CCL price target of $19.62 per share implies 2.72% upside potential.