American cruise liner Carnival Corporation (NYSE:CCL) has won analysts’ bullish views after the S&P 500 stock impressed with solid Q1FY24 earnings. Florida-based Carnival Corp. operates a fleet of nearly 91 cruise ships throughout North America, Europe, Australia, and Asia via well-recognized brands including Aida, Carnival, and Costa Cruises.

Carnival Corp. is a consumer cyclical stock whose performance depends on the business cycle and economic conditions. Following the punishing years of the pandemic, Carnival’s fortunes have reversed as travel and cruise demand has buoyed. Carnival has done a fabulous job in restoring its revenues to pre-pandemic levels. Having said that, the company is saddled with debt and was compelled to issue more shares to keep itself afloat during the pandemic.

In the past year, CCL stock has gained nearly 64%.

Carnival’s Financials are Improving, but Slowly

In its Q1FY24 results, Carnival posted an adjusted loss of $0.14 per share on revenues of $5.41 billion. While the losses were narrower than anticipated, the top line just met the consensus expectations.

Meanwhile, Carnival also warned of its Fiscal 2024 earnings taking a hit (up to $10 million) from the recent collapse of a bridge in Baltimore. Due to the bridge collapse, CCL has had to temporarily relocate one of its regular cruises in Norfolk, Virginia, to help minimize operational changes.

At the same time, Carnival also lifted its full year Fiscal 2024 adjusted earnings guidance to $0.98 per share as well as guided for a higher adjusted EBITDA (earnings before interest tax depreciation and amortization) of $5.63 billion. That’s despite the expected $130 million cost (through November 2024) of rerouting due to conflict on the Red Sea. The cruise liner has cited higher ticket prices, higher onboard customer spends, and growing occupancy levels for its optimistic outlook.

Analysts Bullish About Carnival’s Revival

Following the Q1 print, several analysts reconfirmed their Buy views on CCL stock. Some analysts even lifted the price target on the stock. Macquarie analyst Paul Golding raised the price target on CCL to $24 (46.9% upside) from $22 noting continued demand momentum, extended booking curve, and fundamental strength for the price target update.

Also, Barclays analyst Brandt Montour raised the price target to $25 (53% upside) from $24 thanks to the bullish growth prospects from the pricing strength and booking momentum.

Furthermore, JPMorgan analyst Matthew Boss lifted the price target to $23 (40.8% upside) from $22. Boss is highly encouraged with the overall progress at CCL, including its financial position.

What is the Future of CCL Stock?

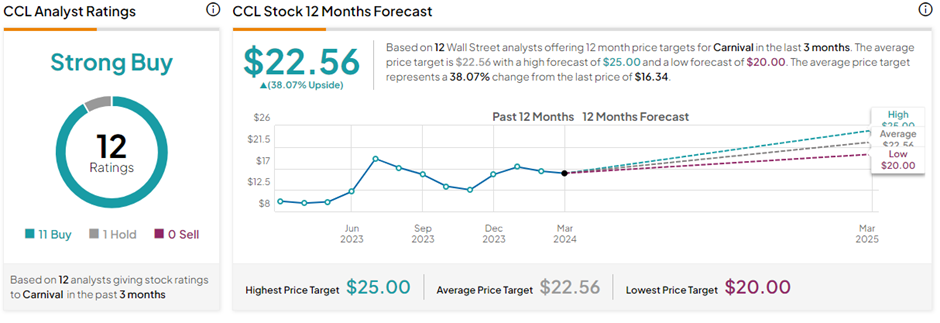

With 11 Buys versus one Hold rating, CCL stock commands a Strong Buy consensus rating on TipRanks. The average Carnival Corp. price target of $22.56 implies 38.1% upside potential from current levels.

Ending Thoughts

Carnival Corp is on a slow but steady path of revival. The company is trying to reduce its debt and improve its bottom line as the demand conditions support the higher ticket prices and growth. Post the Q1 print, analysts are highly bullish about CCL’s stock trajectory and expect robust share price appreciation in the next twelve months.