Earlier today, Cardinal Energy (TSE:CJ), which acquires, explores, and produces crude oil and natural gas in Canada, reported its Q4-2022 and full-year earnings results. The results missed revenue expectations but beat earnings-per-share (EPS) forecasts.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

CJ’s revenue reached C$154.9 million compared to the consensus estimate of about C$177.6 million, but this still represented a 10% increase from last year’s figure. Notably, CJ’s earnings per share were C$0.71, up 196% year-over-year, easily beating estimates of C$0.25.

Additionally, the company’s adjusted funds flow per share increased, coming in at C$0.43 for the quarter, up 30%, and production increased by 4%.

On a full-year basis, revenue increased by 66% to C$737.59 million, diluted adjusted funds flow per share saw a 167% increase to C$2.30, and diluted earnings per share grew by a mere 4% to C$1.92. Importantly, net debt was lowered by 65% year-over-year, and the company bought back 3.7 million shares.

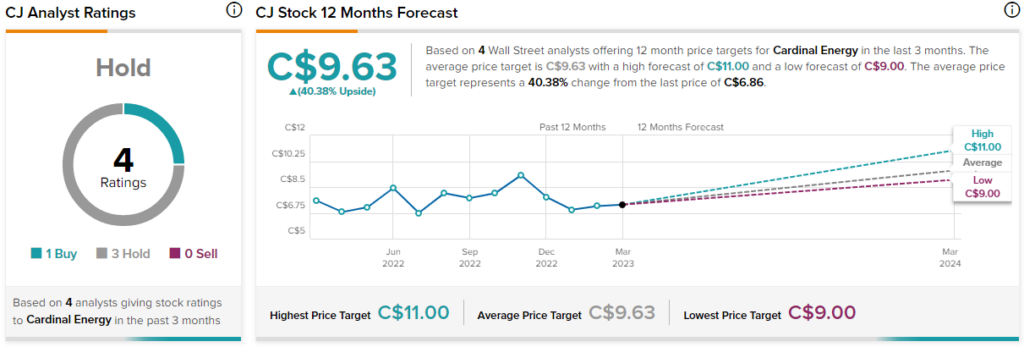

Is Cardinal Energy Stock a Buy, According to Analysts?

According to analysts, Cardinal Energy stock comes in as a Hold based on one Buy and three Hold ratings assigned in the past three months. The average CJ stock price target of C$9.63 implies 40.4% upside potential.