Cardano’s (ADA-USD) first fiat-backed stablecoin, USDM, made a move that is the total opposite of what most cryptocurrency users associate when hearing the word depeg or depegging. The stablecoin, launched by Mehen Finance, surged by 400% at one point this week, just days after its launch, despite being designed to maintain a stable value at $1.

Widespread Community Interest Leads to Dramatic Rise

Exclusively available for minting to eligible institutional buyers in 17 approved U.S. states, USDM quickly became the center of Cardano’s DeFi and DEX population’s attention. It established partnerships with the most prominent decentralized exchanges (DEXs) on Cardano and sparked widespread community interest. However, this interest translated into an unexpected price surge, with USDM dramatically rising to $5, deviating from its $1 peg.

However, due to initial liquidity issues, Mehen advised the community against purchasing USDM at inflated prices. Despite their efforts, the stablecoin’s value fluctuation led to significant losses for those who bought in at peak prices. In response to the spike above $1, Mehen has been working to address concerns about USDM’s performance, stability, and trustworthiness.

Mehen and several of Cardano’s DEXs assure that increased liquidity and broader availability will help mitigate such drastic fluctuations in the future. USDM’s price slid back into the $1 to $1.40 value area.

Cardano’s traders and investors had been clamoring for a fiat-backed stablecoin on the network, but despite that event happening, ADA itself hasn’t had much of a reaction. Instead, Cardano’s performance and price action have been at the mercy of the broader cryptocurrency market – which can’t decide if it wants to continue lower or establish a swing low and resume the prior uptrend.

Technical Analysis for Cardano

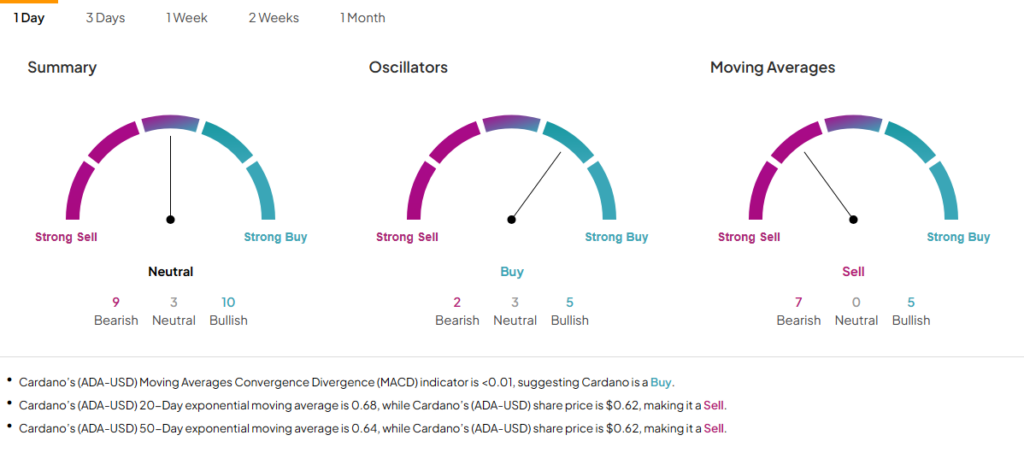

A look at TipRanks’ technical analysis tool shows a mixed picture. The Moving Averages Convergence Divergence (MACD) indicator for Cardano is at <0.01, resulting in a potential Buy signal. However, Cardano’s 20-day exponential moving average sits at $0.68, with its current share price at $0.62, a Sell signal. Similarly, the 50-day exponential moving average is at $0.64, another Sell signal. One interpretation of the MACD and EMAs is that while Cardano is slightly below its EMAs, the MACD is showing small signs that momentum may shift to a bullish outlook soon.

Don’t let crypto give you a run for your money. Track coin prices here