Something strange happened for cannabis stock Canopy Growth (TSE:WEED) (NASDAQ:CGC) recently. First, its shareholders approved a new plan to push into the United States. Then, they promptly punished the company for such plans, abandoning ship in droves and taking over 7% of Canopy’s market cap with them in Monday morning’s trading.

A recent shareholder vote returned substantially in favor of expanding into the burgeoning U.S. cannabis market. This move will give Canopy Growth access to a market that could be worth more than $52 billion by 2026. With the vote successfully concluded, Canopy Growth can launch a new line of stock for a new holding company, Canopy USA LLC.

U.S. Legality Still an Issue

Yet, Canopy Growth’s entry into the U.S. market, which could be a lucrative prize indeed, hinges on one key point: the legality of cannabis in the United States. There are many states in which it’s completely legal and others in which it’s legal for some purposes and not others. Some states have sliding scales of legality based on quantities involved; in Michigan, for example, possession of up to 2.5 ounces at any given time comes with no penalty of any sort.

However, the federal government still declares marijuana an illegal drug, which makes for difficult expansion efforts. Changes seem to be coming but may not be rapid enough to make Canopy Growth’s efforts much more than a particularly expensive moot point.

Is Canopy Growth a Buy, Sell, or Hold?

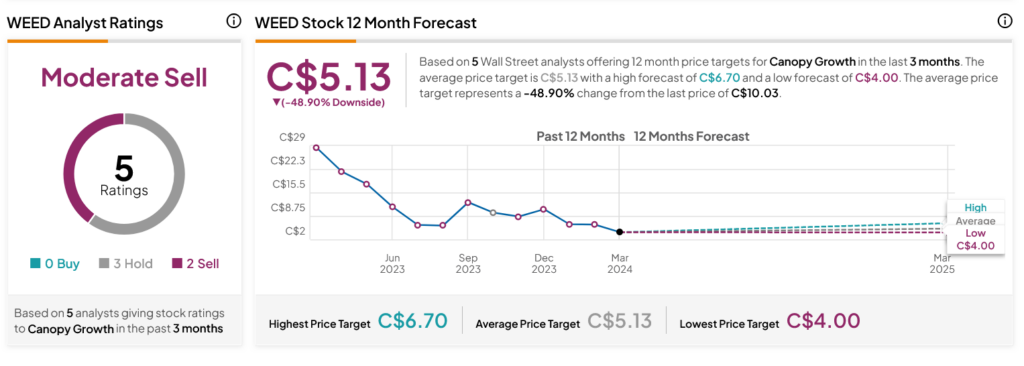

Turning to Wall Street, analysts have a Moderate Sell consensus rating on WEED stock based on three Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 49.6% loss in its share price over the past year, the average WEED price target of C$5.13 per share implies 48.9% downside risk.