Canoo (NASDAQ:GOEV) is a company aspiring to transform the electric vehicle (EV) industry with innovative designs and distinctive technology. However, it is amongst many others aiming to do a similar thing and like others in the space trying to gain a foothold in this new industry, its stock has suffered badly over the past year. To wit, the shares have plummeted by 83%.

There are valid reasons behind the decline. Its financial state is rather shaky, and the company persists in diluting shareholders to sustain its operations. The latest capital raise took place at the end of January via the sale of new warrants to an accredited investor.

However, the company has also begun making progress and has started to deliver vehicles. In Q3, it generated revenue for the first time and Canoo recently announced that the U.S. Postal Service has put in an order for six Canoo LDV 190s, set to be delivered in Q1.

That, says Alliance Global’s Poe Fratt, a Wall Street analyst ranked in the top 1% of stock experts, is a a “major positive.” And while the path ahead might be bumpy, considering the potential and reduced share price, Fratt sees opportunity here.

“The combination of the unique modular design, large order book, ramping production capacity and clearer funding path combine to make Canoo an attractive investment, in our view; we believe that the risk/reward profile is favorable,” the 5-star analyst explained. “While most of the EV space has been under pressure due to limited revenue generation, consistently negative cash flow and capital funding challenges, we believe that the severe stock price weakness has created a risk/reward profile that is positively skewed.”

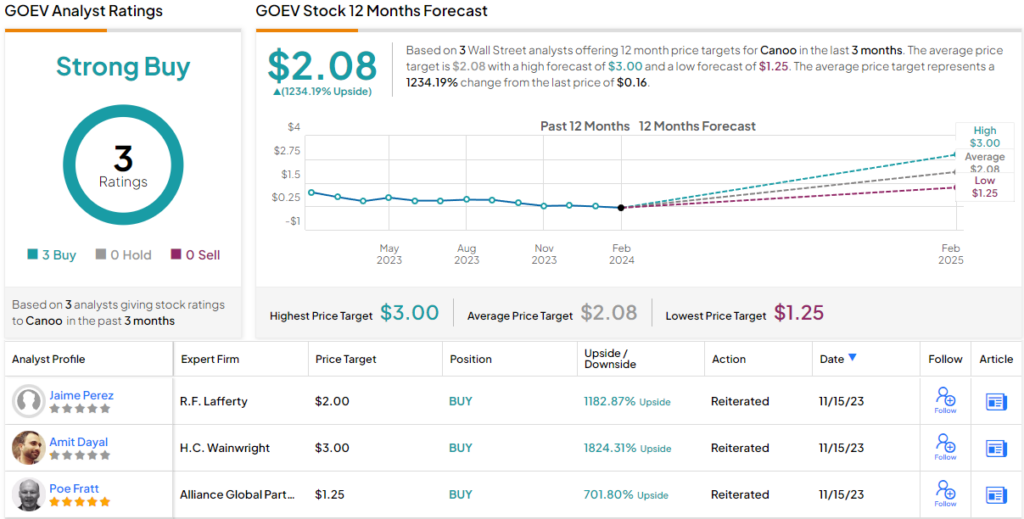

Fratt is bullish indeed. Along with a Buy rating, his $1.25 price target suggests Canoo shares have upside of a humungous 697% from current levels. (To watch Fratt’s track record, click here)

Meanwhile, acknowledging concerns about Canoo’s cash position, Stifel analyst Stephen Gengaro also recognizes the company’s considerable potential within the evolving EV landscape.

“We are encouraged that Canoo has started to deliver vehicles, and management seems optimistic that deliveries will increase in 1H24 and likely ramp more sharply in late 2024 and 2025,” Gengaro said. “On the cautious side, the company continues to burn significant cash, and the ability to raise capital and the dilutive impact it has on shareholders make it very difficult to pinpoint valuation…”

That said, Gengaro also makes the point that the company’s EDVs are “gaining traction with customers” and he sees the potential for serious revenue growth in 2025-27+.

All this is to say, Gengaro rates Canoo shares a Buy, backed by a $0.75 price target. That figure makes room for 12-month returns of a robust 368%. (To watch Gengaro’s track record, click here)

2 other analysts have recently chimed in with GOEV reviews, and they are also positive, making the consensus view here a Strong Buy. The average price target is higher than both analysts above will allow; at $2.08, the figure implies one-year share appreciation of a huge 1234%. (See Canoo stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.