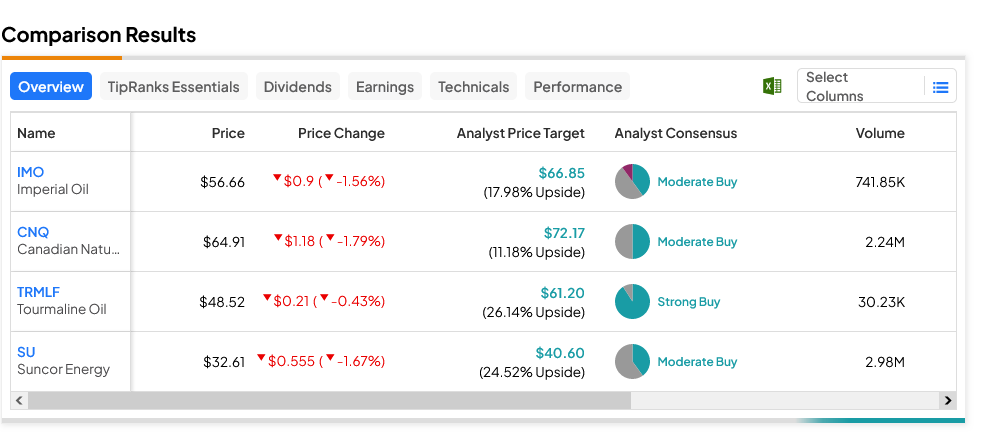

It should have been a good day for stocks in the Canadian energy sector. But energy stocks in Canada took a pasting worse than any hockey night could provide, as several were down despite new interest from analysts. Some had it worse than others, but everyone took a hit. Tourmaline Oil (TSE:TOU) (OTHEROTC:TRMLF) was down fractionally. At the same time, Imperial Oil (TSE:IMO) (NYSEMKT:IMO), Canadian Natural (TSE:CNQ) (NYSE:CNQ) and Suncor Energy (NYSE:SU) all lost slightly better than 1.5% in Wednesday afternoon’s trading.

The decline came at an odd time for the Canadian energy sector, as Bank of America Securities aimed at the entire sector with its recently concluded 2023 Global Energy Conference. It featured the best turnout ever from Canadian operations and thus offered no shortage of perspective. That led analysts to develop a positive view of Canadian energy, noting that improving pipeline capacity would likely engender more production and stronger pricing. One major project, the Trans Mountain Pipeline running from Alberta to British Columbia, is already on track to send an extra 590,000 barrels per day to Canada’s West Coast.

2024 Might be a “Challenging” Year for Energy Stocks

However, the oil market will be a wildly destabilized affair, reports note. With OPEC+ and Saudi Arabia continuing their interventionist path to keep prices higher to make extraction worthwhile, that will prompt the United States and Guyana to get back into the market more strongly. Plus, there’s an ongoing issue of demand destruction to consider as consumers scale back their spending in the face of still-high inflation. That led Bank of America Securities analyst Doug Leggate to declare 2024 a “challenging” year for energy stocks.

Which Energy Stocks are a Good Buy Right Now?

Overall, the leader among the aforementioned energy stocks is TRMLF stock, which offers investors 26.14% upside potential on its average price target of $61.20. Meanwhile, CNQ stock is the laggard, as its average price target of $72.17 gives investors just 11.18% upside potential.