Normally, a large-scale layoff is good for a stock’s share price. For clothing retailer Canada Goose (TSE:GOOS) (NYSE:GOOS), it proved to be anything but as shares fell nearly 3.5% during Tuesday morning’s trading session. There’s no doubt that the layoff was big, but it might have been too much—or perhaps not enough—as far as investors were concerned.

Of course, Canada Goose didn’t call it a “large-scale layoff.” They called it—and brace yourself for this one—“a redesign of our global corporate workforce, as part of our ongoing Transformation Program.” They followed this up by noting it would “represent…a reduction of approximately 17% of corporate roles.”

And while the layoffs were substantial, Canada Goose made the survivors’ lives rougher by comparison by adding duties to pretty much every level of management. For instance, Carrie Baker, the current president of brand and commercial, will now be President of Brand, Commercial, and Design. The Chief Transformation Officer will now also oversee Global Stores, and the President of Finance, Strategy, and Administration will be President of Operations as well.

Chinese Operations Under Fire

While this is bad news for everybody who no longer has a job and those who now have three or four for one salary, the particularly bad news is that there really wasn’t much choice. Back in February, Canada Goose warned investors that its operations in China were coming under fire thanks to an economic downturn that meant a lot less spending.

Some reports noted that Chinese people were increasingly buying military surplus jackets, priced at around $8 each, for use as winter wear. That sort of hurts Canada Goose’s ability to sell jackets that were priced at as much as $2,000 each back in 2021.

Is Canada Goose a Good Company to Invest In?

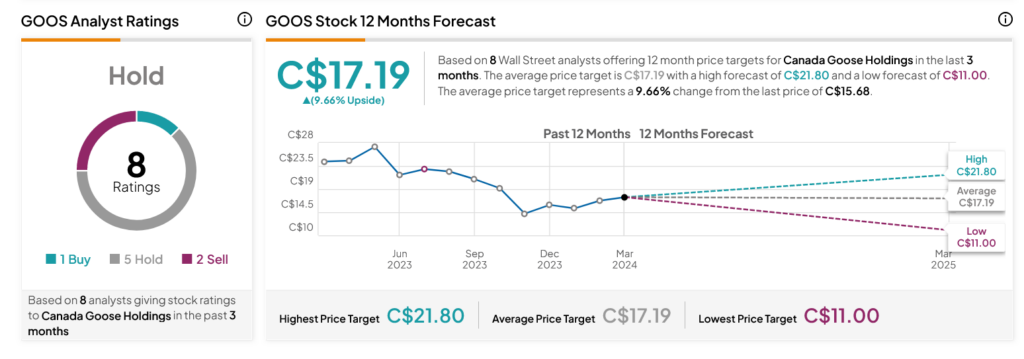

Turning to Wall Street, analysts have a Hold consensus rating on GOOS stock based on one Buy, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 36.46% loss in its share price over the past year, the average GOOS price target of C$17.19 per share implies 9.66% upside potential.