A lot of Canadians out there—businesses and individuals alike—found themselves stocking up ahead of incoming tariffs from one of their biggest trading partners: the United States. That was enough to send Canada’s economy climbing, but will the impact last? Doubt is already emerging as the iShares S&P / TSX 60 Index fund (TSE:XIU), ticked down fractionally in Friday morning’s trading.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

There was good news to be had, even if the reasoning behind it was mostly powered by blinding terror. The real gross domestic product was up 2.2%, which was up from the 2.1% gain seen in the fourth quarter. This beat two sets of analyst expectations, including the StatCan estimate of 1.5% and a Reuters poll that looked for 1.7%.

StatCan spelled out why the gains emerged, noting that Canadian importers and exporters alike were rushing to get out in front of tariffs and ordering much more than normal to build a backlog against those charges hitting. Though not everything was quite so sunny; an uptick in imports—a lot of the reason for the gains—actually hampered the larger number, and a continuing slowdown in housing left the economy not quite as vibrant as it might have been. Still, reports suggest, this may be enough to keep the Canadian central bank from staging interest rate cuts.

About Housing….

Indeed, the housing market in Canada is still kind of in a bit of a disaster right now. We have already heard about the condo market, and the troubled vacation cottage market. As it turns out, though, that is not where the troubles end. The Toronto rental market is also proving sluggish, and landlords are pulling out all the stops to draw interest.

Reports noted everything from a month’s free rent to free Wi-Fi to even gift cards to local merchants valued at up to $500 is on the table as Canada’s landlords realize they have a lot of empty properties right now. In a bid to get them filled, there are no shortage of incentives flying around. Tenants, meanwhile, have discovered their bargaining power, and are putting it to work accordingly. Moreover, reports note that the instability is spreading, going beyond Toronto to the Greater Toronto Area, as well as the Greater Hamilton Area, suggesting more may be on the way.

Is the iShares S&P / TSX 60 Index ETF a Good Buy Right Now?

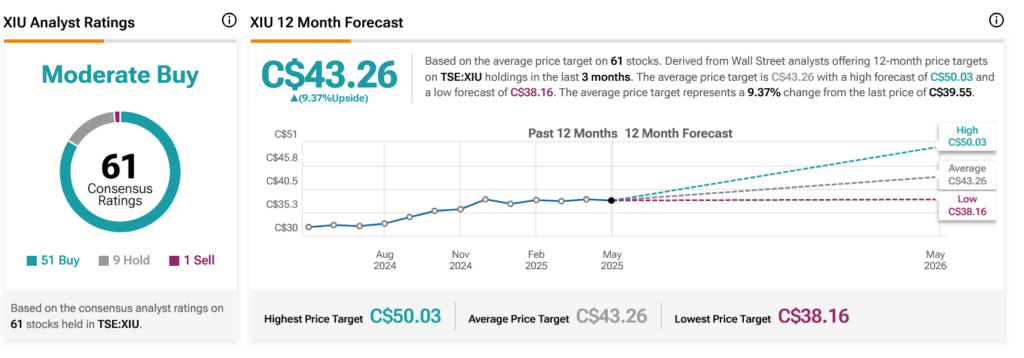

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:XIU shares based on 51 Buys, nine Holds and one Sells assigned in the past three months, as indicated by the graphic below. After a 17.69% rally in its share price over the past year, the average TSE:XIU price target of $43.26 per share implies 9.37% upside potential.

See more TSE:XIU analyst ratings

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue