Headquartered in Boston, MA, General Electric (NYSE: GE) operates as a high-tech conglomerate through its globally installed bases of equipment across several sectors such as Aviation, Healthcare, Renewable Energy, and Power. Shares of the company are down about 22% so far this year.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

For investors interested in the stock, we have presented some facts about the company, along with a snapshot of investor sentiment.

Factors Impacting Performance

While the company finds its healthcare business in the U.S. to be gaining momentum, the same is comparatively weak in some other countries. Moreover, the top-line growth is being marred by the current inflationary environment and supply chain disruptions, as they are causing a delay in the company’s ability to source key materials for its products.

Further, its Renewable Energy segment’s future depends on the U.S. tax credit policy, as U.S. Production Tax Credits (PTC) stand to expire in 2021. Though General Electric is undertaking cost reduction initiatives in the unit, policy uncertainty along with materials and logistics inflation continue to weigh on its performance.

Moreover, GE feels that its Power unit’s performance continues to be “impacted by overcapacity in the industry, continued price pressure from competition on servicing the installed base, and the uncertain timing of deal closures due to financing and the complexities of working in emerging markets, as well as the ongoing impacts of COVID-19.”

Finally, the ongoing Russia and Ukraine conflict, as well as recent COVID-19 impacts in China, remain additional challenges for the company.

Positive Factors

General Electric’s Aviation unit, which comprises about 33% of total revenues, is benefiting from the rise in travel demand. The company noted that as of March 31, 2022, global departures stood at 75% of 2019 levels. Thus, having gauged the possibility of continued recovery to full levels in the next two years, GE has been taking steps to bolster the unit with the capability to meet future demand.

The company cheered shareholders by announcing a share repurchase program for its common stock of up to $3 billion. Also, GE expects a significant gain from the sale of a portion of GE Steam Power to Électricité de France S.A., which is expected to be finalized in the first half of 2023.

Moreover, General Electric is in the midst of its strategic plan to split into three independent companies — with a focus on Healthcare, Aviation, and Renewable Energy, Power and Digital businesses. Healthcare’s tax-free spin-off is expected in 2023, while the combined Renewable Energy, Power and Digital business is projected to separate in 2024.

Also, the full-year 2022 outlook provided by the company reflects overall year-over-year growth, reflecting management’s confidence in its efforts to offset negative factors. Organic revenues are expected to grow in the high-single digits, and adjusted earnings per share are projected to lie between $2.80-$3.50 per share range, compared with $2.12 reported for 2021.

Wall Street’s Take

Recently, Wolfe Research analyst Nigel Coe maintained a Buy rating on GE and lowered the price target to $107 from $121. The new price target implies 47.7% upside potential from current levels.

The analyst is of the opinion that the loss incurred in Renewables in Q1 influences the stock, as it is trading at a considerable discount, “so ring-fencing this business will be key to sentiment.”

Further, Barclays analyst Julian Mitchell’s confidence in the stock’s 2023 guidance is low, as he finds the prospect of operating profit doubling very challenging. Mitchell lowered his price target expectation to $100 (implying 38.1% upside) from $115 while maintaining a Buy rating.

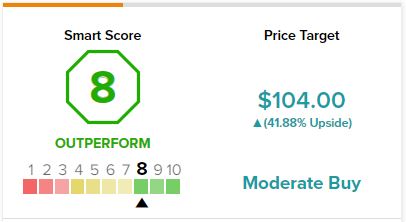

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on nine Buys and four Holds. The average General Electric price forecast of $104 implies 41.9% upside potential from current levels.

Smart Score Rating

General Electric scores an 8 out of 10 on TipRanks’ Smart Score rating system, suggesting that GE is likely to outperform the market averages.

Among the contributing factors, corporate insider transactions, hedge fund manager activity, financial blogger opinions, and news sentiment are all favorable.

Hedge funds — as based on the TipRanks 13-F Tracker — are increasingly buying in. In the last quarter, 22 hedge funds have collectively increased their positions by 1.8 million shares in GE.

Meanwhile, the insider trading picture at General Electric is also bright. “Buy” is the order of the day, as, since January, there have been 44 buying transactions and 19 selling transactions.

Further, TipRanks data shows that financial blogger opinions are 81% Bullish on GE, compared to a sector average of 69%.

As for retail investors who hold portfolios on TipRanks, it is a disappointing picture. The number of investors on TipRanks whose portfolios hold GE is down 0.8% in the last seven days and 1% in the last 30 days.

The Takeaway

The factors impacting the stock’s performance are not likely to go away soon. Thus, a full recovery from the company is expected to take ample time. However, despite these concerns, General Electric has been able to attract positive hedge fund and insider sentiment.

Also, the company’s confidence regarding the performance of its highest revenue-generating segment is another optimistic factor.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue