Abercrombie & Fitch (NYSE:ANF) stock has fallen since I last covered the clothing retailer in March and is down 17% from its peak. Recognizing a more significant margin of safety now that the stock price is lower, I’m relatively bullish on the clothing and accessories brand that has totally reimagined its offering in recent years.

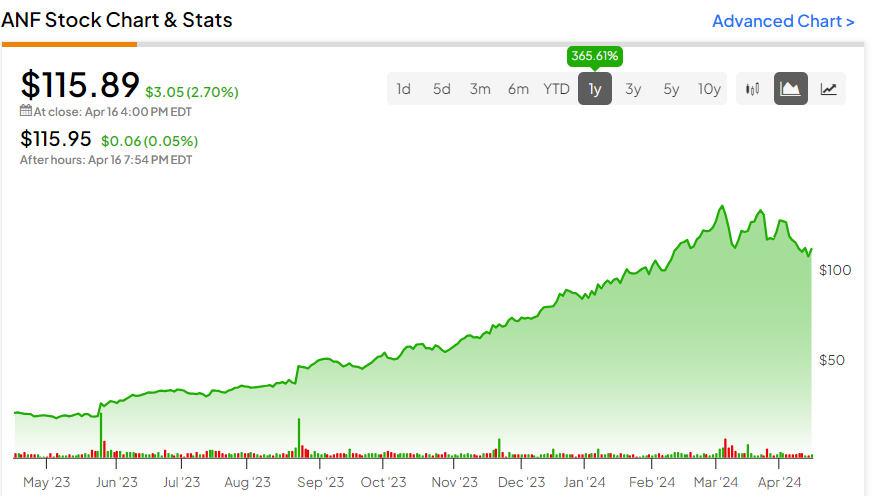

The company remains a significant winner from the past 12 months — the stock has gained 365.6%, as you can see below — and at 14.6x forward earnings, I don’t think it’s particularly expensive.

ANF’s Turnaround Story

Abercrombie & Fitch has implemented one of the most successful turnaround stories in recent times. It may surprise some people to hear that Abercrombie was actually voted the most-hated retail brand as recently as 2016. The company’s earlier focus was on aspirations and attempting to portray an aura of exclusivity. Models were often scantily clad or posed in suggestive ways.

This strategy was intended to appeal to a young audience and generate a sense of desire. But times changed and Abercrombie didn’t — until recently. And it was only two years ago that Netflix (NASDAQ:NFLX) released White Hot, a documentary revealing the culture of discrimination that underpinned the company’s earlier success.

So, what’s happened? Predictably, Generation Z has proven less tolerant of Abercrombie’s exclusivity-focused branding and discriminatory culture than Millennials and older generations. As a result, Abercrombie has shifted to a more inclusive approach, with its marketing now featuring models from diverse ethnicities, body types, and genders. But there’s been more of a strategic shift, with the company now more of an all-American brand that focuses on providing high-quality, often unbadged goods.

Interestingly, management didn’t start attempting to reinvent the company until 2019. However, regardless of whether this rebrand might have been a little late, it certainly appears to be working.

Here’s what CEO Fran Horowitz said in the Q4 earnings call: “From start to finish, 2023 was a defining year for our company. We saw top-line growth across regions and brands resulting in sales of $4.28 billion, up 15.8% to 2022 and our second-highest annual sales level in our history. On profitability, we achieved an operating margin of 11.3%, our best in 15 years.”

ANF Has Strong Financials and Solid Metrics

In Q4, the company registered its smallest earnings beat in six quarters, and to some extent, I believe the company’s momentum is running low. But it’s still in a great position, as fourth-quarter net sales were up 21%, and full-year net sales were up 16%.

Interestingly, it’s Abercrombie — the once exclusivity-focused part of the business — that’s outperforming. Abercrombie led the way with 27% growth on a reported basis and 23% growth on a comparable sales basis. Meanwhile, Hollister delivered total sales growth of 6% on a reported basis and 4% on a comparable sales basis.

Moreover, the success of Abercrombie’s turnaround is reflected in a strong cash position at the end of 2023. Cash and cash equivalents reached $901 million, with total liquidity sitting at approximately $1.2 billion. Operating cash flow for the year was $653 million, significantly contributing to the company’s cash position. Abercrombie has total debt of $1.05 billion, with management significantly reducing the company’s debt burden since 2020.

From a valuation perspective, Abercrombie trades at 14.6x forward earnings. This figure drops to 14x based on projections for 2025 and 13.45x based on the earnings forecast for 2026. While this may make it a little expensive on a price-to-earnings-to-growth ratio, it’s trading broadly in line with its peers. However, momentum is an important thing, and while it’s running a little low compared to six months ago, I’m still hoping to see Abercrombie continue to beat estimates, going forward.

Abercrombie isn’t due to report its Q1 results until May 21, so I fear the stock could remain a little directionless until then. But there are some positive signs. U.S. retail sales surged 0.7% in March after rising 0.9% in February, with shoppers seeming unfazed by persistent inflation. This may be positively reflected in earnings.

Is ANF Stock a Buy, According to Analysts?

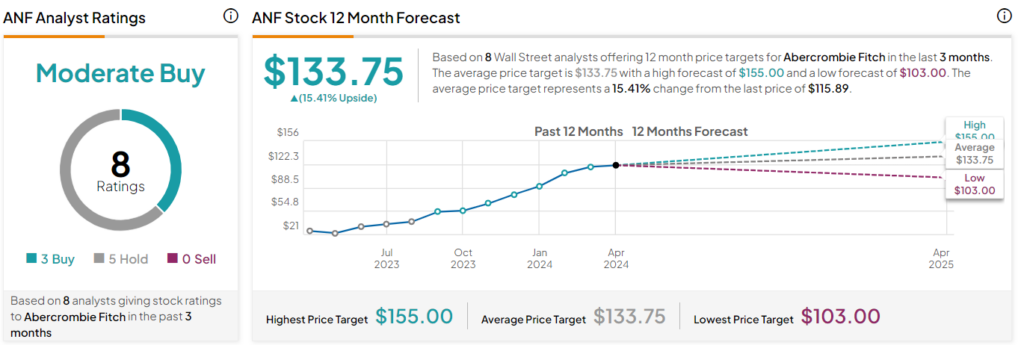

Abercrombie & Fitch stock is rated as a Moderate Buy, according to analysts, with three Buys and five Hold ratings assigned in the past three months. The average Abercrombie & Fitch stock price target is $133.75 with a high forecast of $155.00 and a low forecast of $103.00. The average price target represents a 15.4% change from the last price of $115.89.

The Bottom Line on ANF Stock

Abercrombie & Fitch has undergone one of the most impressive brand turnarounds in recent years. The Abercrombie brand has gone from America’s most hated one to an inclusive all-American retailer that continues to grow sales and bring in new customers.

Despite broadly trading in line with its peers, the company has a strong cash position, manageable debt, and momentum on its side. The company just keeps surprising to the upside, and with strong U.S. retail sales data throughout February and March, I’m backing it to outperform again.