Camden Property Trust (CPT) announced the acquisition of all outstanding partnership interests in its two discretionary investment funds. The transaction involved 22 multifamily communities located mainly in Sunbelt markets.

CPT mainly engages in the multifamily apartment community segment and owns and operates 170 properties. It also has five properties under development at present. CPT shares have been on an upward trajectory, gaining 52.5% over the past 12 months.

CPT earlier owned 31.3% interest in the funds and has now acquired the remaining 68.7% at a gross asset valuation of the funds at $2.1 billion. After adjusting for assumed debt of about $520 million, the consideration for interest acquired is about $1.1 billion.

CPT funded the transaction through available cash and by borrowing under its $900 million unsecured credit line. In addition to the rise in its share price, CPT has been included in the S&P 500 index as well, which is a major positive for investor sentiment.

Hedge Fund Activity

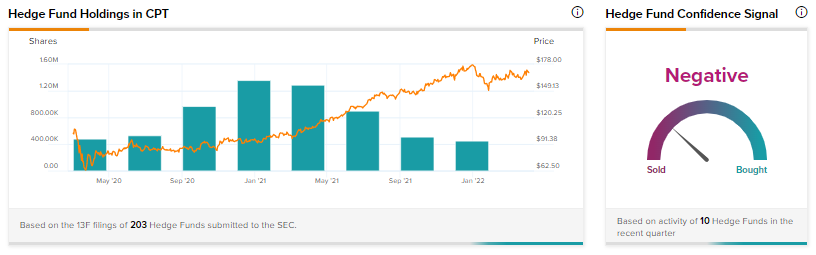

TipRanks data points that Wall Street’s top hedge funds have decreased holdings in Camden Property by 52,600 shares in the last quarter, indicating a negative hedge fund confidence signal in the stock based on activities of 10 hedge funds.

Valuation Speaks

Let us consider some key metrics for CPT and how it fares against the broader industry. CPT’s dividend yield of 2% lags the industry median of 3.2%, indicating that its peers are providing better distributions. After the share price rise over the past year, the price/rental revenue multiple for CPT at 15.8 is significantly higher than the industry median of 8.6, implying that CPT investors are paying a higher price for each rental dollar generated by the company.

Meanwhile, a return on total assets of 3.8% means CPT is better at utilizing its assets than its peers, whereas the industry median is 2.3%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

High Tide Declines 3.1% on Acquisition Plans

Sanofi to List Drug Ingredients Business

Clovis Jumps 22.4% on Positive Data for Rubraca