Citigroup (NYSE:C) surprised investors and analysts as it announced better-than-expected Q1 results. The bank generated Q1 revenues of $21.1 billion, an increase of 1.4% year-over-year, and surpassed analysts’ estimates of $20.4 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Citi reported Q1 earnings of $1.58 per diluted share, a decline of 27.8% year-over-year but above consensus estimates of $1.20 per share.

The bank’s investment banking business generated revenues of $903 million in Q1, a jump of 35% year-over-year driven by the issuance of rising debt and equity. This was above analysts’ expectations of revenues of $805 million.

However, the bank’s fixed-income trading revenue declined by 10% year-over-year to $4.2 billion, due to lower volatility of rates and currencies.

Citigroup’s CEO, Jane Fraser, stated in its earnings release that, March marked an end to the sweeping overhaul it had undertaken last year. Last year, the bank announced plans for deep job cuts and intentions of reducing its costs.

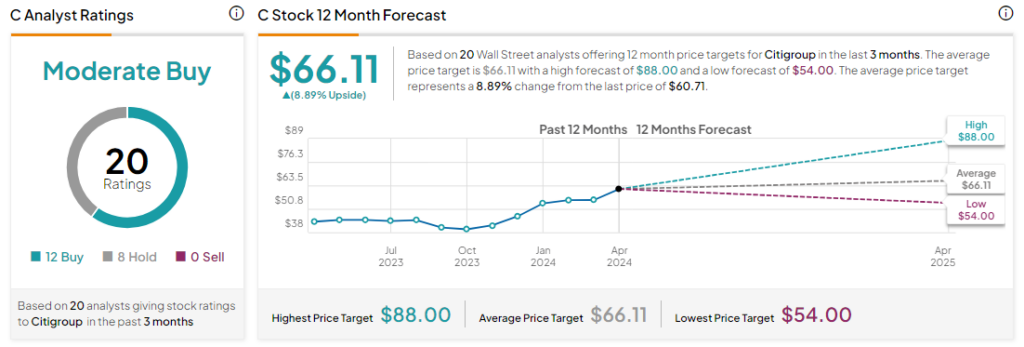

What Is the Price Target for C Stock?

Analysts are cautiously optimistic about Citigroup stock, with a Moderate Buy consensus rating based on 12 Buys and eight Holds. Year-to-date, Citigroup has increased by more than 15%, and the average C price target of $66.11 implies an upside potential of 8.9% from current levels. The analyst ratings are likely to change after the announcement of Citi’s earnings today.