Beyond Meat (NASDAQ:BYND) had its share of troubles of late. With meat prices in the stores starting to look reasonable again, and actually being available for purchase at any price, ersatz meat like Beyond Meat’s isn’t so necessary any more. However, Beyond Meat’s new Beyond Steak is catching its share of attention, causing BYND stock to rise at the time of writing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Beyond Steak—which is pretty much exactly what it sounds like, a steak substitute made wholly from plants—will be available in a range of grocery stores as the result of a newly-inked distribution expansion. National chains like Walmart (NYSE:WMT), Target (NYSE:TGT) and Kroger (NYSE:KR) already offered Beyond Steak to customers. Now, a wider range of regional grocery chains like Whole Foods and Meijer will also get in on the action.

Beyond Steak seems to be making new inroads with customers, thanks to a set of “rave reviews” recently emerging that compliment everything from its “tender and juicy” nature to its “caramelized crust.” Yet, there are already signs that investor interest in ersatz meat is on the decline in general. Even Beyond Meat could only go so far with Beyond Steak. This morning, Beyond Meat was up over 5% at one point. By the noon hour, that number slipped to just over 1%. Newsweek, just in June, detailed how Beyond Meat was worth over $14 billion in 2019, but merely four years later, it was down to just over $827 million. Beyond Meat tends to do well not long after introducing new product—remember the Beyond Sausage bump?—but a lasting impact doesn’t always follow.

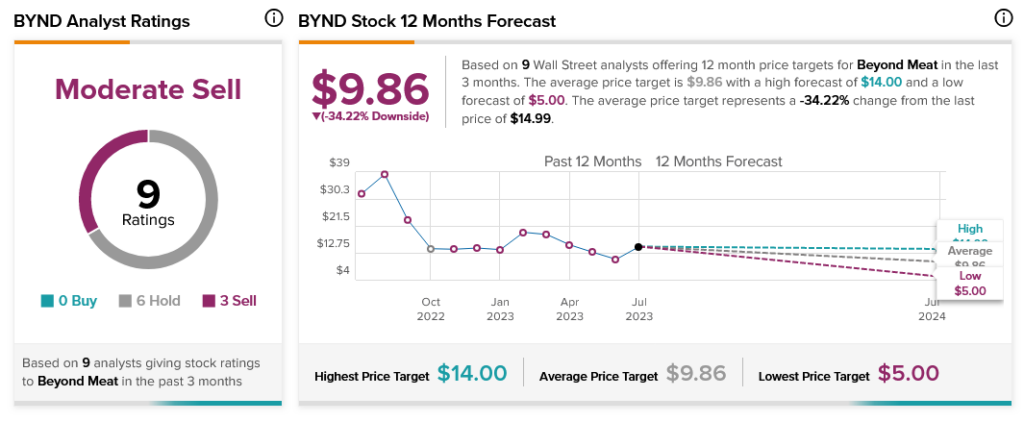

Analysts have underscored this point as well. With six Hold ratings and three Sells, Beyond Meat stock is considered a Moderate Sell by analyst consensus. Further, with an average price target of $9.86 per share, Beyond Meat stock comes with a shocking 34.22% downside risk.