Major brand meat substitute Beyond Meat (NASDAQ:BYND) blasted up in Thursday trading thanks to a new move that landed it on a fresh set of fast food menus. While the company hasn’t had much luck with such moves before, this latest move is offering new hope to investors.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Beyond Meat managed to land McDonald’s (NYSE:MCD) locations in both the UK and Ireland. Now, diners in those locations can get their hands on the “Double McPlant.” That sandwich comes with two Beyond Meat patties instead of the normal cow-based versions. McDonald’s noted that the Beyond Meat burgers had already seen a “…successful launch last year.” Thus, this latest move just expands the offerings available.

However, some analysts are concerned. They figure that the connection to McDonald’s locations in two countries will only do so much for Beyond Meat long term. After several product recalls back in the early days of 2022, Beyond Meat has already had trouble keeping diners interested. Growing competition—worse, competition Beyond Meat isn’t really keeping up with—is giving Beyond Meat serious problems. Further, the overall macroeconomic picture that’s cutting people’s fast-food budgets will also chip away at profitability.

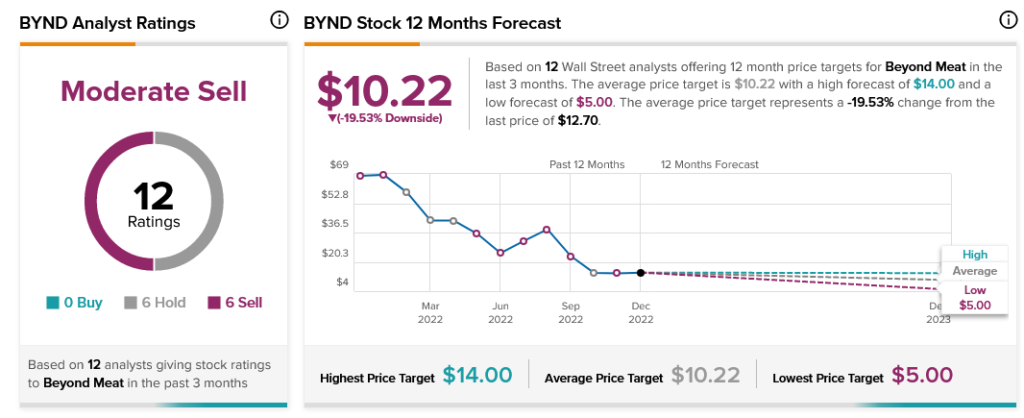

Overall, there’s a growing body of analysts that share these concerns. Currently, Beyond Meat has a Moderate Sell consensus rating. It also has 19.53% downside risk thanks to its current price target of $10.22.