Shares of Chinese electric vehicle (EV) giant BYD Co. (BYDDF) (HK:1211) hit a nine-month low on the Hong Kong stock exchange today after reporting a 12.1% decline in October sales. The company, once China’s top-selling automaker, also lost its position as the leading auto brand despite recording its highest monthly sales for the year. Tesla (TSLA) rival BYD sold 441,706 autos in October, down 12% from 502,675 units in the same month last year. Sales of BYD’s plug-in hybrid vehicles dropped sharply, falling 31.1% year-over-year to 214,297 units.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SAIC Motor took the top spot in October, delivering 453,978 vehicles. Meanwhile, other Chinese EV makers posted robust sales in October. Nio (NIO) sold 40,397 vehicles, up 92.6% year-over-year, while XPeng (XPEV) reported a 76% increase with 42,013 deliveries.

BYD Must Ramp Up Sales to Meet Targets

Following its second sales decline this year, analysts estimate BYD will need to sell about 450,000 vehicles in both November and December to meet its annual target of 4.6 million units.

Year-to-date, BYD has sold 3.7 million vehicles, representing 13.9% growth from the same period last year. Battery-electric vehicles (BEVs) led the growth, rising 34.5% year-over-year to roughly 1.8 million units. In contrast, plug-in hybrid sales slipped 2.7% to about 1.8 million units. The company’s commercial vehicle segment surged 128% in October to 4,850 units, with cumulative sales up 240% year-over-year to 46,134 units in the first ten months.

BYD Faces Mounting Challenges

BYD’s recent sales setbacks coincide with China’s tightening restrictions on auto discounting. The automaker also reported its second consecutive quarterly profit decline last week, pushing shares to new lows. Over the past six months, BYDDF shares have fallen 22.2%.

BYD’s third-quarter profit dropped 33%, while revenue declined 3%, marking the company’s first revenue drop in more than five years, amid rising competition from domestic players.

Is BYD Stock a Strong Buy?

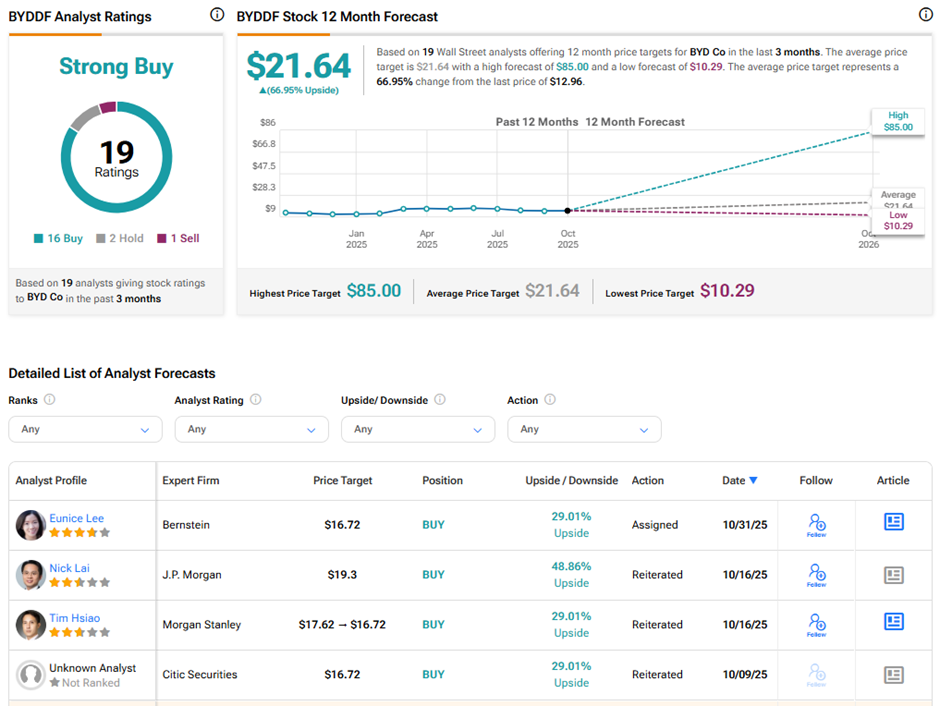

Analysts remain optimistic about BYD’s long-term outlook. On TipRanks, BYDDF stock has a Strong Buy consensus rating based on 16 Buys, two Holds, and one Sell rating. The average BYD price target of $21.64 implies nearly 67% upside potential from current levels.