Everyone loves a bit of drama and luckily there’s usually enough supply on Wall Street.

The latest palaver has Planet Fitness (NYSE:PLNT) in the spotlight, with the fitness chain’s shares slipping recently and the company facing a potential boycott after an incident involving a trans member at one of its gyms.

So, what exactly happened? Last week, a woman encountered a transgender individual in the women’s locker room at a Planet Fitness branch in Alaska. After taking a photo, she raised her concerns with the staff and later shared a video detailing her experience, along with the picture, on social media. Planet Fitness addressed her complaint a few days later, emphasizing their policy allowing members to use facilities based on their self-identified gender. Following which, they revoked her membership for violating their Mobile Device Policy, which prohibits capturing photos or videos in locker rooms. The incident got plenty of attention on social media, with reposts and commentary from notable figures, prompting some groups to advocate boycotting Planet Fitness gyms. To date, Planet Fitness has issued a statement reaffirming their non-discrimination policy and explaining the decision to cancel the membership.

Given how these stories have a tendency to gather momentum, Stifel analyst Chris O’Cull thinks it will be “important for the company to gain control of the narrative quickly.”

“Fortunately,” the analyst goes on to reassure, “social media comments have a short shelf life when it comes to search, whereas news stories last longer, so having positive earned media highlighting the brand’s ‘judgement free’ positioning can prevent search results with a shorter shelf life from continuing to impact the brand’s reputation. Monitoring how the narrative unfolds in the coming days will be important.”

Also standing in the company’s stead is the fact O’Cull reckons Q1 joins will come in better than anticipated, or at least in line with Street expectations of an increase of 890,000 from 4Q23.

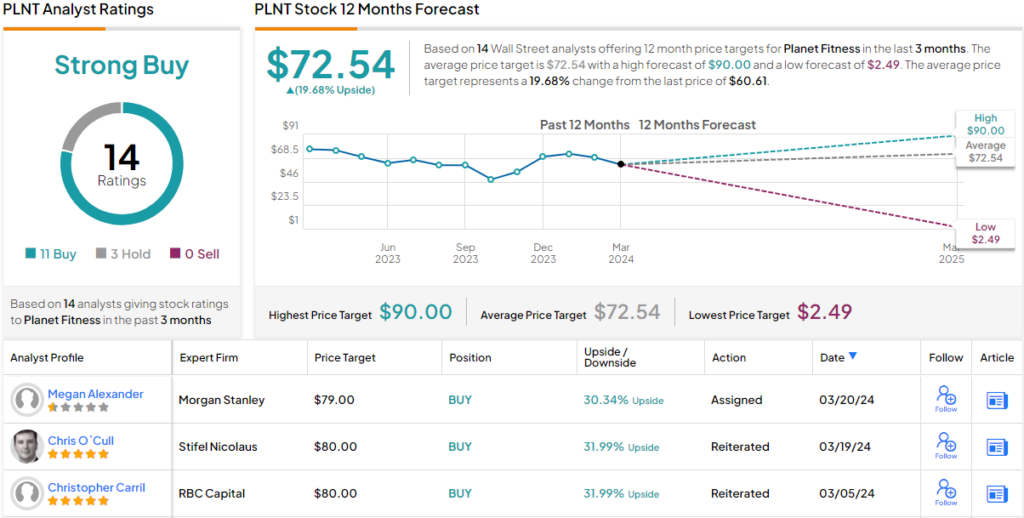

Bottom-line, the analyst believes the market is “likely overreacting to this situation.” As such, O’Cull maintained a Buy rating on the shares backed by an $80 price target, suggesting the stock will climb 42% higher in the months ahead. (To watch O’Cull’s track record, click here)

Most analysts are thinking along the same lines. The stock’s Strong Buy consensus rating is based on 11 Buys against 3 Holds, all culminating in a Strong Buy consensus rating. At $72.54, the average price target factors in 12-month returns of ~20%. (See PLNT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.