The headwinds have been piling up for Apple (NASDAQ:AAPL). The data is pointing to soft iPhone sales, including in key China market and the tech giant has abandoned its plans for the Apple Car, meaning no future revenue on that front. Additionally, there are concerns about regulatory scrutiny impacting its Services business in various regions.

However, at the same time, J.P. Morgan analyst Samik Chatterjee notes that hedge funds are “eyeing the headwinds to create a more tactical entry point.”

“Contrary to the deterioration of fundamentals relative to both Hardware demand as well as outlook for Services growth, the interest in AAPL shares have improved from the broader group of investors who have otherwise been averse to the premium valuation multiple despite one of the lowest growth outlooks relative to the other Mega Cap Tech stocks,” the 5-star analyst explained.

Chatterjee sees two main reasons for the growing enthusiasm despite the “challenging fundamentals.” For one, AAPL stock is down by 12% year-to-date, representing a more appealing valuation with the shares now trading near the “lower end of the range of multiples the shares have traded at recently since the launch of the 5G phone (i.e. iPhone 12).” Secondly, there’s the upcoming AI led iPhone upgrade cycle. Similar to the momentum seen during the 5G-led upgrade cycle, investors are sensing the opportunity to ride this wave of AI-driven upgrades.

In anticipation of the 5G upgrade cycle, Apple stock went through a “multiple re-rating” that began in the year heading into the launch of the first 5G device. Considering the iPhone 16’s launch is coming up in September, the timeline for re-rating appears to be condensed. However, interestingly, Chatterjee thinks it’s not the next iPhone that will be the AI-driven gamechanger, as it will only have cosmetic AI features, but the following iPhone 17, which will be released next year.

Meanwhile, Chatterjee rates Apple shares an Overweight (i.e., Buy) along with a $210 price target. Investors stand to score a 24% gain, should Chatterjee’s thesis go according to plan in the year ahead. (To watch Chatterjee’s track record, click here)

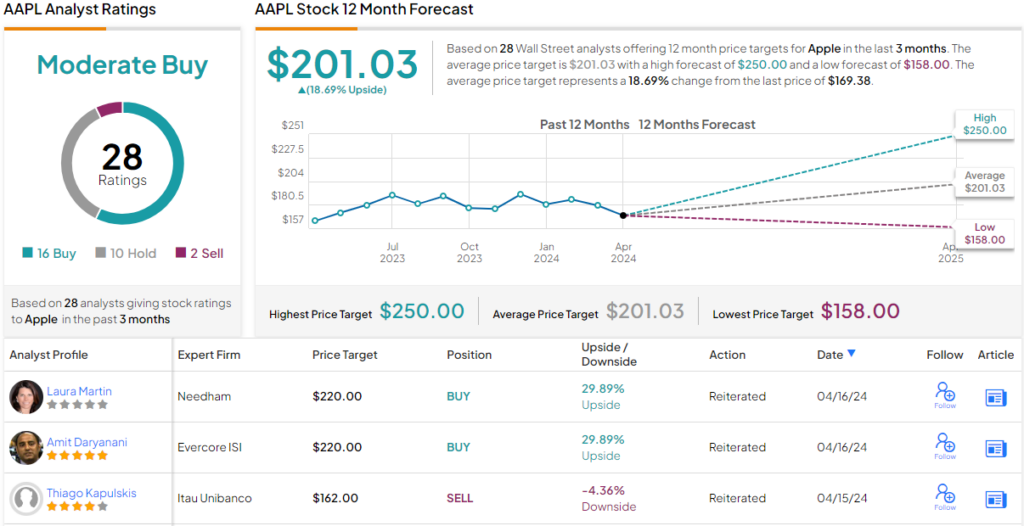

The Street’s average price target is a touch lower; at $201.03, the figure makes room for one-year returns of ~19%. Rating wise, based on a mix of 16 Buys, 10 Holds and 2 Sells, the stock claims a Moderate Buy consensus rating. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.