Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A) continues to accumulate shares of Occidental Petroleum (NYSE:OXY). As per TipRanks’ Insider Trading Activity Tool and an SEC filing, Berkshire purchased 5.99 million shares of Occidental in multiple transactions between September 26 to September 28, at prices ranging from $57.52 to $58.18. The aggregate amount of these transactions is $352.5 million. According to a Reuters report, with this latest round of purchases, Berkshire’s stake in Occidental has increased to 20.9% from 20.2%.

Berkshire’s stake in Occidental Petroleum stock allows it to include the proportionate share of Occidental’s earnings with its own operating results under the equity method of accounting. Berkshire also holds $10 billion worth of Occidental’s preferred stock and warrants to purchase 83.9 million shares of common stock at $59.624 per share.

Note that in August, the Federal Energy Regulatory Commission (FERC) approved Berkshire’s request to purchase up to 50% stake in Occidental. Occidental shares have skyrocketed nearly 112% year-to-date due to the growing interest of Berkshire in the company and the rise in energy prices triggered by the Russia-Ukraine conflict. That said, OXY stock has been under pressure recently due to fears of an impending recession.

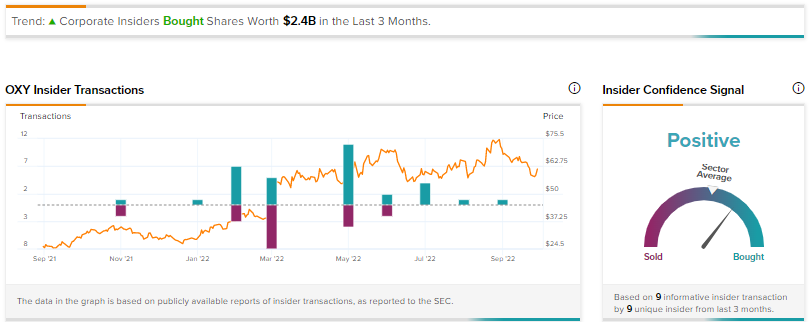

Overall, TipRanks’ Insider Trading Activity Tool reveals that corporate insiders have bought shares worth $2.4 billion in the last three months, which essentially reflects the purchases made by Berkshire. The Insider Confidence Signal is Positive for OXY stock.

Interestingly, TipRanks also offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is Occidental Petroleum a Good Stock to Buy?

Consensus among analysts is a Moderate Buy based on five Buys, seven Holds, and One Sell rating. The OXY stock price target of $77.50 implies 26.2% upside potential.

Aside from the Wall Street community, Hedge funds are also confident about Occidental. As per TipRanks’ Hedge Fund Trading Activity tool, the Hedge Fund Confidence Signal is Very Positive for Occidental. Overall, Hedge Funds increased their holdings by 18.8 million OXY shares in the last quarter.