Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) continues to load up shares of the oil company Occidental Petroleum (NYSE:OXY). With the recent purchases between May 16 and May 18, Buffett’s conglomerate raised its stake to 24.4% from 23.8%.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

According to the SEC filing, Berkshire bought over 3.46 million shares of Occidental at prices ranging from $58.11 to $58.66, for an aggregate value of $200 million. Based on the closing price of $58.25 per share on Thursday, Berkshire now owns about 217.3 million OXY shares worth $12.7 billion.

Interestingly, Buffett purchased OXY stock on each of the last six trading days. In the period between May 11 and May 15, he bought 2.2 million shares worth $125.7 million.

Occidental attracted Buffett’s interest in early 2022, when energy prices soared due to the Ukraine-Russia war. It is worth mentioning that his stake in OXY stock is by far the highest in the oil and gas sector. Noticeably, Buffett has been buying OXY stock whenever its price falls below $60 per share.

Is OXY Stock a Buy or a Sell Now?

One of the key reasons Buffett favors Occidental is its strong cash position, which continues to support dividend payouts. Also, the company’s strong presence in the Permian Basin and efforts to improve storage and pipeline capacity for transporting oil and gas are encouraging.

Wall Street analysts are cautiously optimistic about OXY stock. It has a Moderate Buy consensus rating based on nine Buys, seven Holds, and one Sell. The average price target of $71.59 implies 22.9% upside potential.

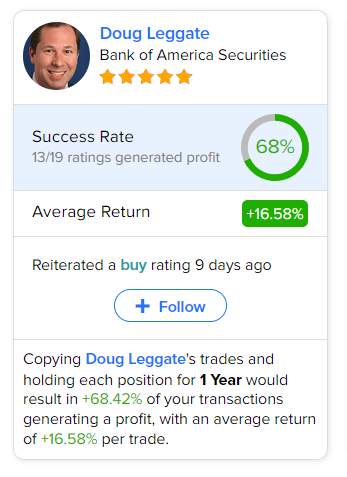

As per TipRanks data, the most accurate analyst for Occidental is Bank of America Securities analyst Doug Leggate. Following Leggate’s advice, each trade for one year could result in 68% of your transactions generating a profit, with an average return of 16.58% per trade. Importantly, the analyst reaffirmed his Buy rating on OXY stock about nine days ago.