Before market open today, BRP Inc. (TSE: DOO)(NASDAQ: DOOO), which sells power sports vehicles such as boats and ATVs, released its Fiscal Q2-2023 earnings results. Both earnings per share (EPS) and revenue came in stronger than expected. The company also increased its full-year guidance. As a result, the stock is trending higher in today’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BRP’s generated record quarterly revenue, coming in at C$2.44 billion, up 28% on a year-over-year basis. This beat the consensus estimate of about C$2.3 billion. The company’s normalized earnings per share came in at C$2.94, beating the C$2.61 estimate, showing 2% year-over-year growth.

In addition, its normalized EBITDA was C$418.3 million, just better than the C$415 million figure in the same quarter last year. However, BRP’s gross profit margin dropped to 24.7% compared to 29.9% last year.

Next, the company’s guidance certainly pleased investors. For the full year, BRP is projecting revenue to increase by 26% to 31% year-over-year, compared to the previous forecast, which was 200 basis points lower. Last year’s revenue figure of C$7.65 billion. Therefore, this year’s revenue should come in at around C$9.8 billion at the midpoint of management’s guidance.

Lastly, normalized diluted EPS is forecast to be C$11.30 to C$11.65, C$0.30 higher than before.

Is BRP Inc. a Good Stock to Buy?

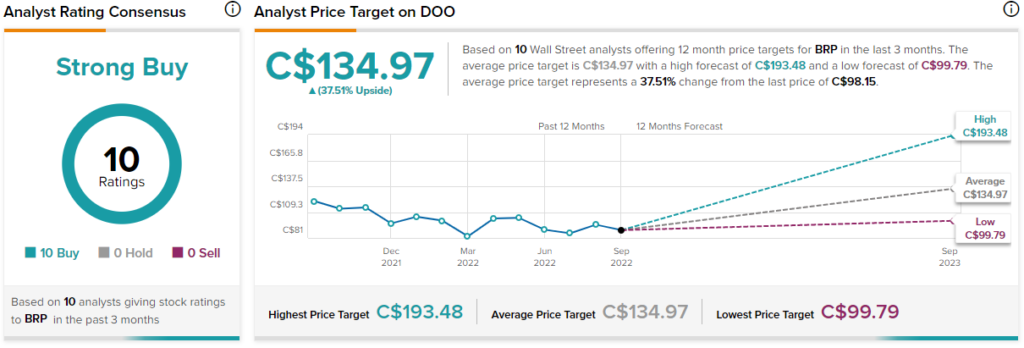

Turning to Wall Street, BRP Inc. stock earns a Strong Buy consensus rating based on 10 unanimous Buy ratings assigned in the past three months. The average BRP Inc. (DOO) stock forecast of C$134.97 implies 37.5% upside potential.

Conclusion: BRP’s Results Pleased Investors, but They Weren’t Perfect

BRP’s results were better than expectations in every aspect. This caused the stock to rally in today’s trading session so far. However, profitability growth didn’t match with revenue growth, and the company’s gross margin dropped. Nonetheless, BRP Inc. looks like a solid growth stock. It also has the backing of analysts, who are unanimously bullish on the stock. Therefore, it’s a stock worth considering.