Brookfield Asset Management (BAM) and Brookfield Asset Management Reinsurance Partners announced the creation of Brookfield Reinsurance.

Brookfield Asset Management is a Canadian alternative asset management company focused on private equity, infrastructure, renewable power, and real estate. (See Brookfield stock chart on TipRanks)

CEO of Brookfield Reinsurance and CIO of Brookfield, Sachin Shah, said, “We are excited to be launching Brookfield Reinsurance, which establishes a scalable platform for our growing insurance businesses and provides investors with an alternative, efficient means through which to hold an interest in Brookfield.”

The asset manager said for every 145 class A and class B shares of Brookfield, shareholders received one class A exchangeable share of Brookfield Reinsurance. Each exchangeable share can be exchanged for one class A share of Brookfield or its cash equivalent.

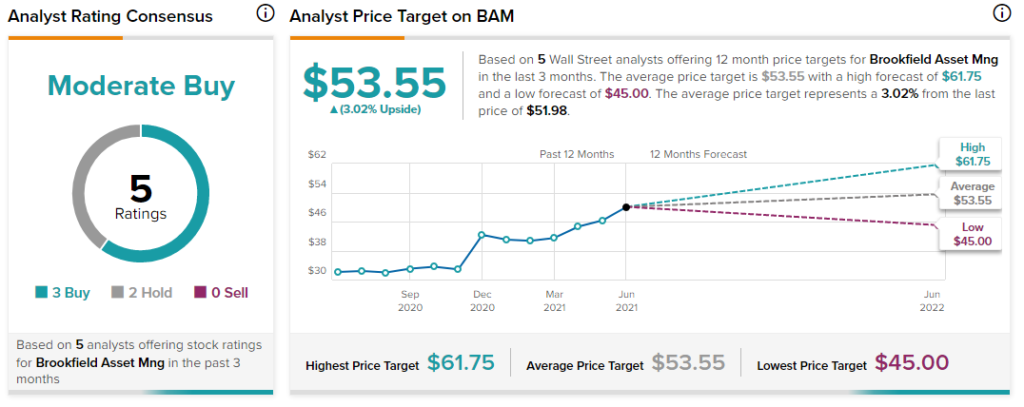

J.P. Morgan analyst Ken Worthington recently reiterated a Buy rating on the stock and raised the price target to $61.75 (18.8% upside potential) from $57. The analyst views the company’s shares as attractive and considers Brookfield a top investment idea for the second half of the year.

Overall, the stock has a Moderate Buy consensus rating based on 3 Buys and 2 Holds. The average Brookfield price target of $53.55 implies 3% upside potential from current levels. The company’s shares have gained 43.8% over the past year.

Related News:

U.K. Regulator to Investigate Amazon, Google Over Fake Reviews – Report

Etsy to Acquire Brazilian E-Commerce Marketplace for $217M

Johnson & Johnson to Pay $263M to Settle Opioid-Related Claims