Well, we’ve finally come to the end of the long, strange road that was the Broadcom (NASDAQ:AVGO) and VMWare deal. But not everyone is quite so happy about how it all turned out. While investors did push chip stock Broadcom fractionally higher, a much larger investor also revealed possible plans to bail out.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That investor is none other than private equity firm Silver Lake, previously one of VMWare’s largest shareholders, who will be selling off the Broadcom stock it landed as a result of the VMWare sale to Broadcom. At least, most of it; Silver Lake is expected to take possession of the new shares on Monday and will likely sell off the lion’s share of them, about $5 billion worth, reports note. Meanwhile, investors are also wondering what Michael Dell will do with his Broadcom shares. Dell was formerly the biggest owner of VMWare, with 155 million shares, and that translates to a substantial chunk of Broadcom.

Reactions Are, At Best, Mixed

Meanwhile, the market is taking the new deal in somewhat of a mixed fashion. For instance, Jim Cramer noted that he expects Broadcom shares to get a lot more attention when they clear the $1,000 per share mark. That’s not hard, but actually getting to that point may be a bigger problem. Especially if more newly minted Broadcom owners start following in Silver Lake’s footsteps. Meanwhile, reactions to the deal range from relief and being generally pleased about it all to some finding it a nigh-apocalyptic and “outright terrifying” event.

What is the Target Price for Broadcom Stock?

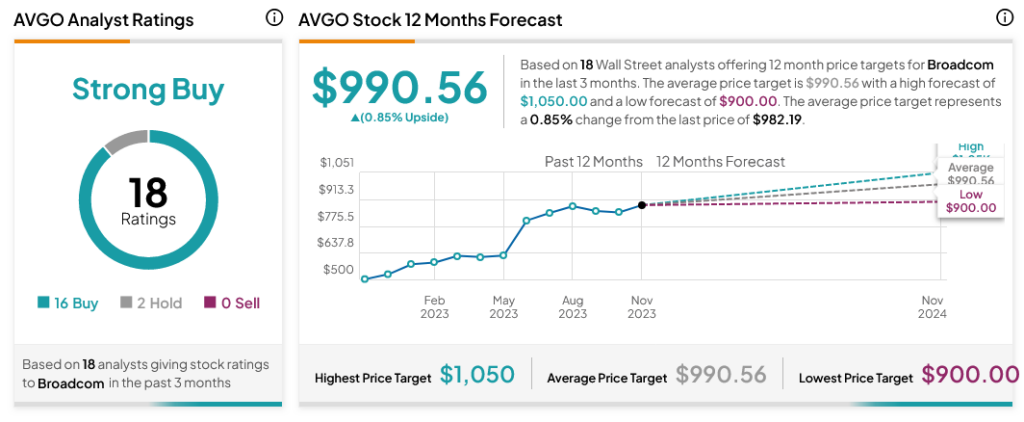

Turning to Wall Street, analysts have a Strong Buy consensus rating on AVGO stock based on 16 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After an 88.65% rally in its share price over the past year, the average AVGO price target of $990.56 per share implies 0.85% upside potential.