British Airways (GB:IAG) is to cut 10,000 flights this winter as the airline industry struggles to recover post-pandemic amid staffing struggles, strikes and rising fuel costs.

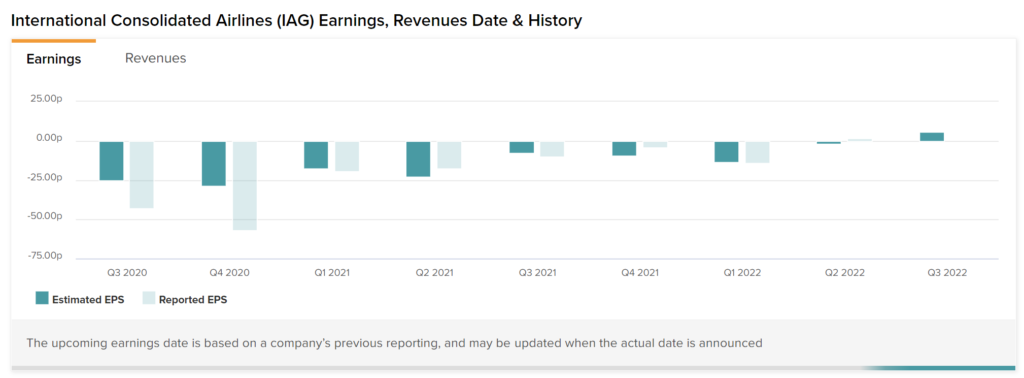

IAG, the parent company of British airways, returned to profit in July with an operating profit of €293 million compared to a loss of €967 million in 2021.

The airline said in a statement, “While the vast majority of our customers will travel as planned and we’re protecting key holiday destinations over half-term, we will need to make some further changes up to the end of October.”

The move came after Heathrow Airport extended its ‘cap’ on passenger numbers from September until the end of October.

Heathrow passenger cap

Heathrow said: “We are asking our airline partners to stop selling summer tickets to limit the impact on passengers.

“We recognise that this will mean some summer journeys will either be moved to another day, another airport or be cancelled and we apologise to those whose travel plans are affected.

“But this is the right thing to do to provide a better, more reliable journey and to keep everyone working at the airport safe.”

The airline industry had been hoping for a surge in demand after the pandemic to regain lost revenues – but airlines have faced cancelled flights, long queues at airports, and a shortage of staff.

BA recently reached an agreement with its employees to end strikes, which provided some relief. The deal includes an 8% increase in pay and a temporary bonus.

In separate news, Wizz Air Holdings (GB:WIZZ) fell 9.89% after the company’s CFO Jourik Hooghe exited the budget airline to see ‘opportunities outside the company’.

The European carrier hopes to find a turnaround following a loss of €285m.

What is British Airways stock price?

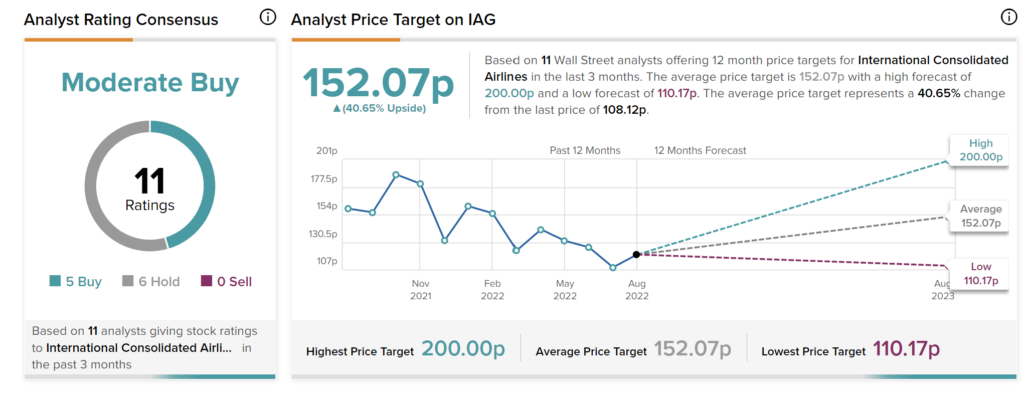

According to TipRanks’ analyst rating consensus, International Consolidated Airlines’ stock is a Moderate Buy. This is based on ratings from 11 analysts, out of which five are Buy and six are Hold.

The average price target is 152.07p, which shows an increase of 28.14% on the current price. The analyst price target has a high and low forecast of 200p and 108.17p, respectively.

Is IAG a good stock?

These cancellations illustrate the struggles facing airlines going into winter, but IAG’s recent results show the group is in a good place.