International Consolidated Airlines (GB:IAG), the parent company of British Airways, operates the majority of its flights from Heathrow – and has paused all ticket sales until August 15, aiming to reduce new bookings.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Last month, Heathrow advised airlines to reduce their flights and also set a cap of 1,00,000 passengers on a daily basis. Overall, BA has cut around 30,000 flights in the peak summer season. The capping will continue until September 11.

BA said in a statement, “As a result of Heathrow’s request to limit new bookings, we’ve decided to take responsible action and limit the available fares on some Heathrow services to help maximise rebooking options for existing customers, given the restrictions imposed on us and the ongoing challenges facing the entire aviation industry,”

Heathrow Airport welcomed this move and praised BA for giving priority to its passengers.

IAG’s share price was down by 2.7% after the announcement on Tuesday. The shares were up by 2.8% the next day.

Chaos at Heathrow

The airline industry, had been waiting for a surge in demand after the pandemic to regain lost revenues – but faced cancelled flights, long queues at airports, and a shortage of staff.

BA recently reached an agreement with its employees to end the strikes, which provided some relief. The deal includes an 8% increase in pay and a temporary bonus.

Competitor airlines EasyJet (GB:EZJ) also followed a similar path and struck a deal with the employee union to call off the strikes after revising pay.

View from the city

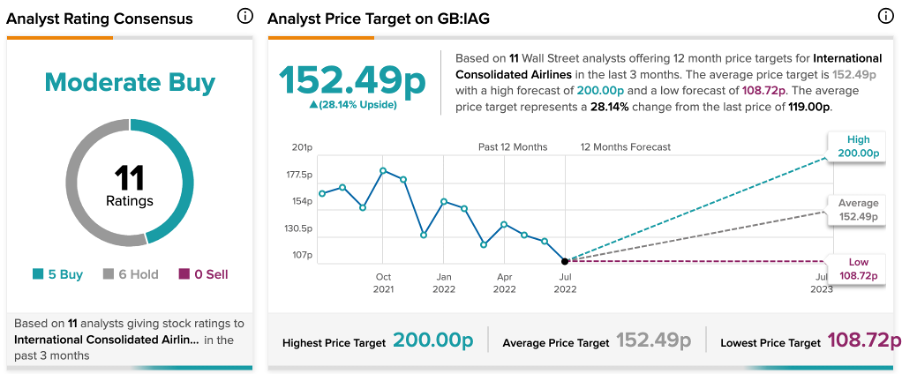

According to TipRanks’ analyst rating consensus, International Consolidated Airlines’ stock is a Moderate Buy. This is based on ratings from 11 analysts, out of which five are Buy and six are Hold.

The average price target is 152.5p, which shows an increase of 28.14% on the current price. The analyst price target has a high and low forecast of 200p and 108.7p, respectively.

Conclusion

The silver lining in this storm is that passenger demand is back on track.

BA’s employees are back to work, and passengers are happy with fewer flights at the airport. The company is well positioned for solid top-line growth.