The Board of Directors of Bristol Myers Squibb (BMY) has approved an increment to the quarterly common dividend, and authorized a new share buyback program.

Following the news, shares of the American pharmaceutical company soared 4.8% to close at $59.05 on December 13.

Dividend Hike

On December 10, the Board approved a 10.2% increase in the quarterly common dividend to $0.54 per share. This increment makes the annual dividend for fiscal year 2022 to $2.16 per share with a dividend yield of 3.66%.

This is the thirteenth consecutive dividend increase by the company. The dividend is payable on February 1, 2022, to shareholders of record on January 7, 2022.

Additionally, the Board also approved a quarterly dividend of $0.50 per share on its $2.00 convertible preferred stock. The preferred dividend will be paid on March 1, 2022, to shareholders on record as of February 1, 2022.

Share Buyback Program

BMY’s Board also authorized a new share buyback program for an additional $15 billion on the company’s common stock. The total amount available under the share buyback program is approximately $15.2 billion.

Management Comments

Chairman of the Board and CEO of BMY, Giovanni Caforio, said, “With significant free cash flow of $45 billion to $50 billion expected between 2021 and 2023, investment in business development continues to be a key priority for the company in driving innovation and sustained growth as we return capital to shareholders through the dividend increase and expanded share repurchase authorization. We remain committed to maintaining a strong investment-grade credit rating and reducing our debt.”

See Analysts’ Top Stocks on TipRanks >>

Analysts’ View

Recently, Wells Fargo analyst Mohit Bansal initiated the stock coverage with a Hold rating and price target of $58, which implies 1.8% downside potential to current levels.

According to Bansal, BMY has a difficult path ahead with continuous patent losses. He views the near-term business profile as choppy and sees faster Hematology erosion versus consensus.

Overall, the stock has a Moderate Buy consensus rating based on 5 Buys and 5 Holds. The average Bristol Myers Squibb price target of $68.88 implies 16.7% upside potential to current levels. Shares have lost 1.5% over the past year.

Investors

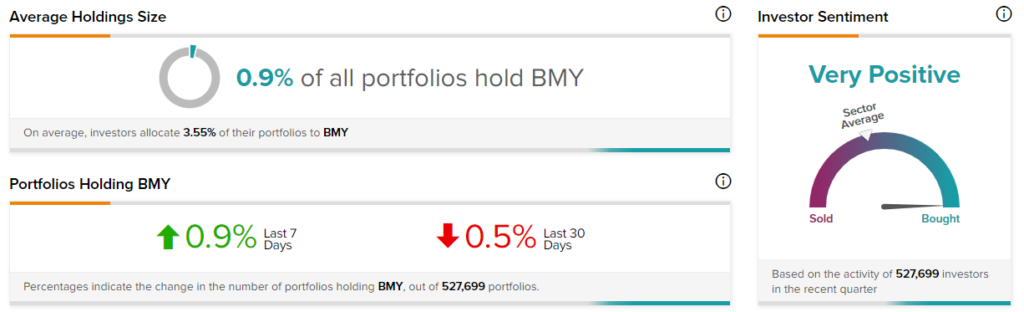

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Bristol Myers Squibb, with 0.9% of portfolios tracked by TipRanks increasing their exposure to BMY stock over the last 7 days.

Related News:

Abbott Rewards Shareholders; Shares Record New All-Time High

Novavax Files for EUA in the UAE; Shares Up 4%

Finland Picks Lockheed Martin for F-35 Jet Delivery