Shares of biopharmaceutical major Bristol-Myers Squibb (NYSE:BMY) are ticking marginally higher today after the company expanded its partnership with Avidity Biosciences (NASDAQ:RNA) in a $2.3 billion deal. This development has pushed Avidity shares nearly 25% higher in the morning session already.

This global licensing and research collaboration will focus on bringing up to five cardiovascular targets to the market by utilizing Avidity’s AOC (Antibody Oligonucleotide Conjugates) platform technology. The deal involves an upfront payment of $100 million, milestone payments of up to $2.2 billion, and up to low double-digit royalties for Avidity.

Importantly, AOCs can target the root cause of diseases that were, until now, untreatable with RNA therapeutics. Now, the partnership between the two companies promises to widen the reach of AOCs.

In 2021, Avidity teamed up with BMY subsidiary MyoKardia to demonstrate the potential of AOCs in cardiac tissue. The new collaboration will include the acquisition of nearly $40 million of Avidity shares by BMY at $7.88 per share.

What is the Future of BMY Stock?

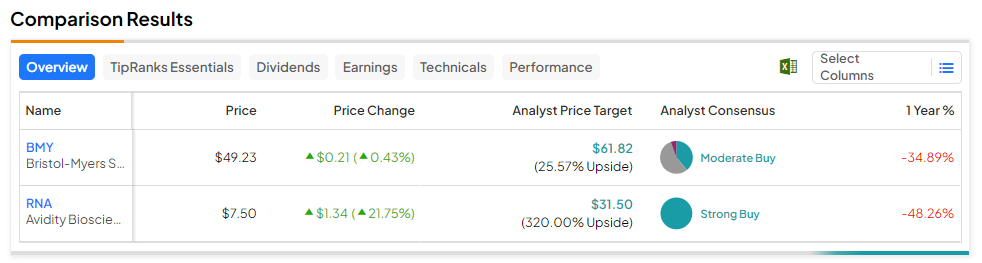

Overall, the Street has a Moderate Buy consensus rating on Bristol-Myers Squibb, and the average BMY price target of $61.82 implies a 25.6% potential upside in the stock. Despite today’s price gains, shares of BMY and RNA still remain nearly 35% and 48% lower over the past year, respectively.

Read full Disclosure