Pharmaceutical giant Bristol Myers Squibb (NYSE:BMY) has entered into an agreement to acquire biotechnology company Mirati Therapeutics (NASDAQ:MRTX) for $5.8 billion. The deal, which is expected to enhance Bristol Myers’ oncology portfolio, involves a cash payment of $58 per share worth $4.8 billion. It also includes non-tradeable contingent value right (CVR) for each Mirati share held, potentially worth $12 per share, reflecting an additional $1.0 billion of value opportunity as per the company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, Mirati stock surged 45% on October 5 following a Bloomberg report about a potential acquisition by Sanofi (NASDAQ:SNY).

BMY Enhances Oncology Portfolio

Bristol Myers Squibb intends to finance the Mirati acquisition with a combination of cash and debt. The deal is anticipated to close by the first half of 2024. The transaction is expected to be dilutive to BMY’s adjusted earnings per share (EPS) by about $0.35 in the first 12 months following its closure.

The Mirati deal marks further expansion of the company’s oncology portfolio, especially after the acquisition of Turning Point Therapeutics for $4.1 billion last year. In particular, the Mirati deal will add the Krazati lung cancer drug to BMY’s commercial portfolio.

Krazati won the U.S. Food and Drug Administration’s (FDA) approval for the treatment of adult patients with KRASG12C-mutated locally advanced or metastatic Non-Small Cell Lung Cancer (NSCLC) in December 2022. The acquisition will also provide Bristol Myers Squibb access to Mirati’s several other promising clinical assets complementing its oncology offerings.

Overall, BMY is making strategic acquisitions to mitigate the impact of loss of revenue from patent expirations of key drugs later this decade.

Is Bristol Myers a Buy, Hold, or Sell?

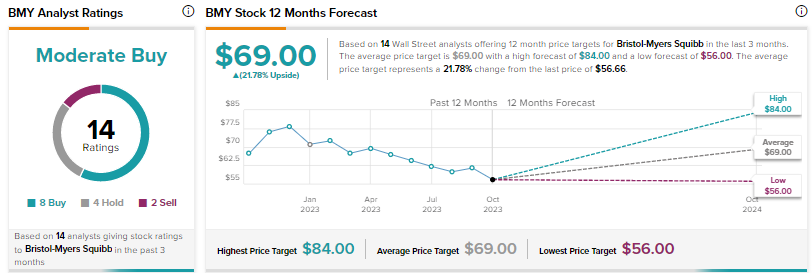

Wall Street is cautiously optimistic on Bristol Myers Squibb stock, with a Moderate Buy consensus rating based on eight Buys, four Holds, and two Sells. The average price target of $69 implies about 22% upside potential.